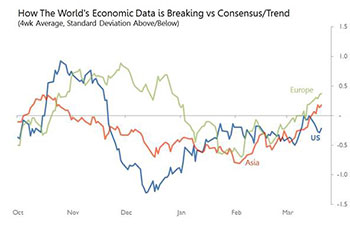

Although business headlines continue to assert that bad times are just around the corner, an increasing proportion of the world’s economic data is arriving better than expected. In fact, that proportion is now at its highest since the beginning of December. Both Asia and Europe are driving this upturn, whilst the US is still treading the path of mild disappointment, as it has since early December. .Asia: The most positive flow of news during the week was the rise in March’s foreign currency reserves, which was reported almost everywhere, with even China’s reserves rising $10.3nb mom. This return in international confidence helped push the 4wk performance vs consensus to its best since early November. US: This was a light week for economic news, but despite the unexpected strength of trade data, the numbers generally continue to mildly disappoint consensus expectations. Europe: The region’s economic news continues to beat consensus expectations with increasing frequency. However, this week’s gains were heavily influenced by Germany’s recent trade strength, which the fall in factory orders suggests is under threat in the short to medium term. |

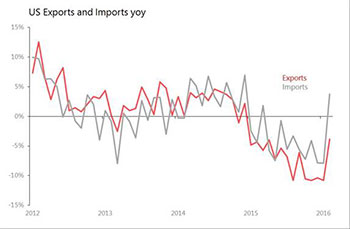

Opportunities and threats This week’s key surprises and shocks are already identifying the way currency movements are reversing the winners and losers in the world economy: the key surprise of the week was the strength of US trade numbers; the key shock was the sudden erosion of Germany’s factory orders.There’s a logic at work here. Under the strong dollar regime which erupted in mid-2014 and lasted until near the end of last year, the clear losers were China and those emerging economies who had either linked their currencies to the dollar, or, alternatively, relied on commodities exports to underpin their national finances. The winners, meanwhile, were the two big non-US industrial economies of Japan and the Eurozone, which enjoyed both the competitive advantage of depreciated currencies and the fall in the price of industrial commodities. Under a weakening dollar, the roles are reversed. The weaker dollar wrests comparative advantage back to the US and dollar-linked emerging markets, whilst the stabilisation or rise in commodity prices provides relief for commodity exporters. Meanwhile, Japan and the Eurozone discover themselves to be leaking competitive advantage at exactly the same time as their margins are squeezed by higher commodity prices. Three key surprises US trade values recover sharply US exports and imports have been falling sharply and virtually uninterruptedly since August 2014, hit by the strength of the dollar and the associated fall in trade prices. Between August 2014 and January 2016, seasonally adjusted exports fell 10.6 percent in dollar terms, whilst export prices fell 10.3 percent. Import prices also dropped hard, falling 15 percent between August 2014 and January 2016, but importers carved out market share, so despite the price fall, the value of imports dropped only 6.9 percent. This weakness in US trade prices and values really matters because it gets echoed around the world. In the 12 months to January the US accounted for 46 percent of G3 imports, the highest proportion for more than a decade. And it is G3 import demand which sets the tempo for Northeast Asia’s export-oriented industrial base. February’s trade data gave the strongest signal to date that this decline may finally be bottoming out. Exports rose one percent mom seasonally adjusted, which was the first monthly rise since September; before adjustments they fell 3.9 percent yoy, but with a monthly gain which was 2.2 standard deviations (SDs) better than historic seasonal trends. The 6m deviation against that trend turned positive for only the second time since October 2014. More, it was exports of goods which fared best, rising 1.6 percent mom, led by consumer goods, autos and F&B. Service exports, by contrast, dipped by 0.1 percent mom seasonally adjusted (sa). Imports, meanwhile, rose 1.3 percent mom seasonally adjusted, and, perhaps more impressive, before adjustments rose 3.7 percent yoy on the back of a monthly jump which was 2.3SDs better than trend. This was the first positive yoy comparison since March 2015. This import strength came despite a six percent mom fall in petroleum products (by volume) and a five percent mom drop in vehicles. Year on year comparisons in world trade values have been expected to stabilise from February-March this year because it’s then that the negative impact of the dollar’s rise during 2H14 and early 2015 finally begins to fall out of the data. So whilst back in December the dollar was up 5.4 percent yoy against the SDR basket of currencies, by February the gain had fallen to just 1.4 percent, and by March the dollar was actually down 0.9 percent yoy against the Special Drawing Right (SDR). We should expect the end of the dollar’s rise to feed through, eventually, into a more modest decline in dollar trade prices (for all the world’s trading nations), and consequently to improved trade values. However, the gains made in the US’s February’s trade values were stronger than expected, and arrived faster than the adjustment in export prices. In fact, during February, US export prices fell 0.4 percent mom and fell six percent yoy, showing no improvement whatsoever in trend; import prices also fell 0.3 percent mom and fell 6.1 percent yoy, and similarly, there was no improvement against trend. This, of course, underlines the potential significance of February’s strength: from here on, it will get much easier for US trade values to surprise on the upside. And in turn, that surprise factor will be repeated in Asia’s export numbers. |

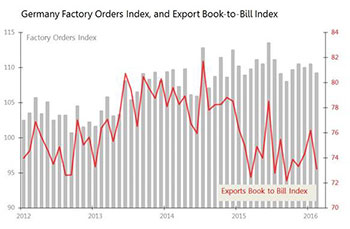

Japan Consumer Confidence Friday 8th April • Japan March consumer confidence surprises up 1.6pts to 41.7 – Rebounds from Feb’s Shocker – Overall livelihood up 2pts to 40.5 – Confidence in employment up 1.7pts to 43.9 – Willingness to buy durables up 1.7pts to 41.7 – Income growth up 0.8pts to 40.6 Germany industrial production stronger than expected Three key shocks Germany factory orders fall as export orders dry Mostly, it seemed that German industry had a busy February, with industrial production beating consensus expectations by rising 1.3 percent yoy, and exports also beating consensus by rising 1.3 percent mom sa and 4.1 percent yoy with a monthly gain which was 1.4SDs better than historic seasonal trends. But then came the news that February’s factory orders dropped 1.2 percent mom sa and rose only 0.5 percent yoy. This was unexpected. Germany’s domestic demand isn’t slacking, with orders up 0.9 percent mom, but foreign orders dropped 2.7 percent mom, with orders from the Eurozone down 3.7 percent mom, and the rest of the world down 2.1 percent. Foreign orders for Germany’s consumer goods dropped 10.4 percent mom, capital goods fell 3.9 percent mom, but orders for industrial intermediates rose 2.4 percent. As far as Eurozone demand is concern, there were severe falls for consumer goods (down 10.8 percent mom) and capital goods (down seven percent). The weakness lodges a question mark over the immediate prospects for Germany’s industry. First, it depresses Germany’s exports book-to-bill ratio back toward the bottom of the levels endured throughout 2015, snuffing out a promising recovery seen during the previous three months. More, this comes just as the competitive advantage enjoyed throughout 2015 from the weakness of the Euro against the dollar during 2H15 and 2015 begins to reverse. In December the Euro was down 11.8 percent yoy against the dollar; by February it was down only 2.4 percent yoy, and so far in April it is up 5.5 percent yoy. The road gets steeper from here. Second, it begins to look as if the overall trend for Germany’s factory orders is deteriorating from mere stasis seen between mid-2014 and mid-2015 to a mildly falling trend. This, incidentally, is anomalous: data from most of the rest of the world, excluding Japan, looks to have passed the worst of the dollar-inspired gloom of 2015. Maybe upturns achieved outside the Eurozone will be strong enough to resuscitate demand for Germany’s industrial exports. That, at least, is what German industry must now be hoping. |

US IBD/TIPP economic optimism Tuesday 5th April • April IBD/TIPP Economic Optimism Disappoints down 0.5pts to 46.3 – Weakest since Nov 2015 – Federal policies down 0.9pts to 40.3 – Economic outlook down 0.6pts to 40.6 – Personal financial outlook unchanged at 58.1 Japan economy watchers – outlook |

For more information:

Michael Taylor

Coldwater Economics

Tel: +44 (0) 1653 692518

Mobile: +44 (0) 7989 858 695

Skype: coldwater.econ

Website: www.coldwatereconomics.blogspot.com

To subscribe to Michael Taylor’s Economics Briefing, click here