By Greg Mayew | January 30, 2019

In this edition of Frasers newsletter they report on the following:

(i) Notification on registration of a trademark licence;

(ii) Draft Decision on the encouragement mechanism for the development of solar power projects in Vietnam; and

(iii) New circular on enterprise registration.

Notification on registration of trademark licences

As of January 14, 2019 trademark licence agreements are no longer required to be registered in order to be effective towards third parties:

- On February 1, 2019 the National Office of Intellectual Property (the NOIP) published on its website Notification No. 1926/TB-SHTT (the Notification) confirming the application of certain articles of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CP-TPP) relating to intellectual property as from the CP-TPP effective date being January 14, 2019.

- Referring to Article 18.27 of the CP-TPP, the Notification confirms that since the CP-TPP effective date (ie January 14, 2019) trademark licence contracts are legally effective toward third parties regardless of their registration with the NOIP (therefore eliminating the registration requirement provided under Article 148.2 of the current Law on Intellectual Property). The Notification also informs that the change applies to applicants of all member-countries of the WTO or of the Paris Convention on protection of industrial property (and therefore it is not limited to just the CP-TPP member countries).

- We note however that the Notification is a guideline for NOIP operation (ie intended for internal use), and therefore it is not binding for other relevant authorities, such as the General Department of Taxation or the State Bank of Vietnam. Such authorities will therefore need to issue their own guidelines in order to implement the provisions of the CP-TPP in their respective sectors.

Draft Decision on the encouragement mechanism for the development of solar power projects in Vietnam

The current Decision No. 11/2017/QD-TTg of the Prime Minister, dated April 11, 2017, providing the encouragement mechanism for the development of solar power projects in Vietnam (Decision 11), is in effect only until June30, 2019. On February 22, 2019, the Ministry of Industry and Trade of Vietnam (MOIT) published a new draft Decision on the same matter to replace Decision 11 (Draft Decision).

While Decision 11 was merely distinguishing between grid-connected solar power projects and rooftop solar power projects, the Draft Decision now subdivides grid-connected solar power projects into three different groups, based on the solar power technology utilised by each project, as follows:

- “Floating solar power project”, defined as a grid-connected solar power project with photovoltaic panels installed on the floating surface of the water, directly connected to the electricity grid of the Power Purchaser (as defined in accordance with Article 3.6 of the Draft Decision);

- “Ground solar power project”, defined as a grid-connected solar power project with photovoltaic panels installed on the ground, directly connected to the electricity grid of the Power Purchaser; and

- “Solar power project integrating storage system”, defined as a grid-connected solar power project using an electrochemical storage device for the purpose of storing electricity, directly connected to the electricity grid of the Power Purchaser. The storage system is required to have a minimum storage capacity of 25 percent of alternating transmit power for 2 hours.

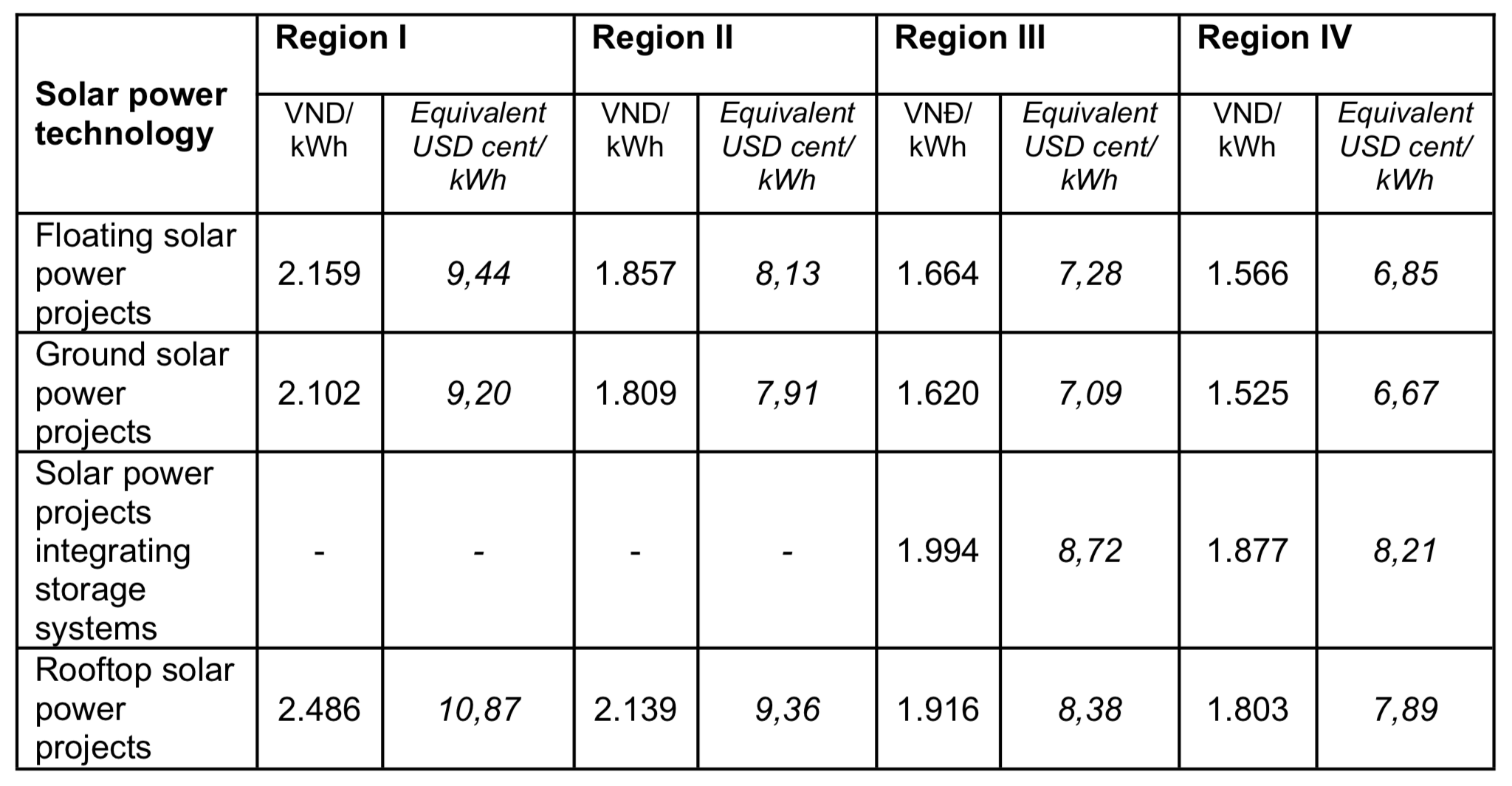

The Draft Decision also provides new power purchase tariffs applicable to the power output from grid-connected projects and rooftop solar power projects, which vary according to the different solar power technologies adopted and to the geographical region where each project is located. Geographical regions are divided into four groups (including Region I, II, III and IV, as specified in Annex A of the Draft Decision), and applicable purchase tariffs are set out as follows:

The power purchase tariffs of the power output from grid-connected projects shall only apply to grid-connected projects which have a solar cell performance ratio of more than 16 percent or have a module of more than 15 percent, and which reach commercial operation before June 30, 2021 (noting that this date, while published on EVN’s website, is not expressly mentioned in the Draft Decision, and may therefore be amended further).

Circular on enterprise registration

On January 8, 2019, the Ministry of Planning and Investment (MPI) issued Circular No. 02/2019/TT-BKHDT (Circular 02), amending Circular No. 20/2015/TT-BKHDT in relation to enterprise registration.

Amongst other changes, Circular 02 provides a range of new standard forms and templates to be used for carrying out business registration procedures (New Forms). Circular 02 will take effect on March11, 2019.

According to Circular 02, any application for enterprise registration submitted prior to March 11, 2019 should still use the old forms as provided for under the previous legislation. Therefore, if an application is submitted on March 10 using the old forms, the relevant DPI should accept such application as valid.

With respect to applications for enterprise registration to be submitted on or after March 11, 2019, however, it is still unclear whether the relevant local DPI will require the New Forms to be used immediately. It is therefore likely that local DPIs may in practice take different views on this point, unless and until a notification or instruction on this point is issued by the MPI. For this reason, it would be prudent to contact the relevant DPI before submitting an application for enterprise registration after March 11, 2019, in order to obtain a confirmation as to which forms shall be used.

——–

We trust that you find this edition of our newsletter an interesting read and welcome any feedback or comments you may have on any of our topics. Our address for comments is legalenquiries@frasersvn.com.

Whilst we aim to provide a useful update on new legislation, Frasers’ Newsletter does not constitute formal legal advice. Should you feel that you require further information on any of the issues in this edition of the Newsletter, please contact us at the address above or via your usual Frasers’ legal adviser.