Published in Asian-mena Counsel: Mergers & Acquisitions Special Report 2019

There is a greater focus on smaller, more strategic deals that attract less scrutiny from government officials, writes Nick Ferguson.

After a record-breaking year in 2016, Chinese regulators have been cracking down on overseas acquisitions, particularly debt-funded deals for over-priced trophy assets.

This is clearly visible in the data for outbound M&A. PwC’s analysis of transactions in 2018 shows China outbound M&A falling for the third straight year, but the cause is more complicated than a simple regulatory crackdown. In addition to policy factors and capital controls, the consultancy firm also attributes the dwindling outbound deal flow to less access to financing, greater scrutiny of Chinese bidders in many jurisdictions and a generally uncertain environment for overseas deal-making.

Government officials are now scrutinising mega-deals much more closely, which has brought an end to some of the headline-grabbing acquisitions in the natural resources sector that reached their peak in 2012 with Cnooc’s US$15 billion deal to buy Canada’s Nexen. Deals for iconic hotels and buildings are also a thing of the past, with some of the most infamous acquisitions being unwound in 2018 — HNA has been selling down its US$6.5 billion investment in Hilton Worldwide and Anbang has been seeking buyers for Strategic Hotels & Resorts, which it bought for US$5.5 billion in 2016, and New York’s Waldorf Astoria hotel, which it bought in 2015 for US$1.95 billion.

Today, there is a greater focus on smaller, more strategic deals that attract less scrutiny from government officials. Buoyed by sky-high valuations, Chinese tech firms have been leading the outbound charge with a series of acquisitions in emerging markets in 2018, including Alibaba investing in Indonesia and Didi Chuxing buying Brazil’s 99 Taxis. China’s obsession with luxury brands also continued, with Fosun buying French fashion house Lanvin and Shandong Ruyi Group acquiring Swiss shoemaker Bally.

Outbound M&A might be going under the radar, but overall deal values were almost exactly the same in 2018 as they were in 2017. Yes, outbound deal values were down 23 percent, but private equity (PE) transactions almost completely offset this to bring the total value of Chinese M&A to US$678 billion — roughly 11 percent off the 2016 high point.

Chinese PE investment activity hit new records in 2018 at US$222 billion, which is slightly higher than 2016, which is driven by an abundance of capital, high demand for funding in the private sector and a boom (some say a bubble) in the tech and fintech sectors. The standout deal was the US$14 billion acquisition of Ant Financial by a consortium led by GIC — the largest buyout deal worldwide in 2018.

Asia Pacific

Overall, there were 4,036 deals in the Asia-Pacific (ex-Japan) region in 2018, worth a total of US$717.4 billion, according to Mergermarket, which represents a small 2.6 percent increase in value and a drop of 42 by deal count compared to 2017.

In terms of sectors, industrials and chemicals was the most active by both value and volume, with US$115.2 billion across 832 deals, an increase of 23.5 percent in value compared to 2017. This was led by Wanhua Chemical’s US$12.7 billion acquisition of Yantai Wanhua Chemical.

There were also some significant deals in India during the year, including the largest deal to target the region in 2018 — Walmart’s US$16 billion acquisition of Indian online retailer Flipkart. This transaction helped to push Indian M&A to the highest annual value on record, according to Mergermarket. At US$99 billion, India is now the second most targeted country behind China, fuelled at least in part by the country’s new bankruptcy code, which was passed in 2016 and is providing a significant M&A opportunity for the acquisition of distressed companies.

Across the region, both outbound and inbound M&A experienced growth. Private equity firms remained active, despite buyout activity experiencing a dip, with 514 deals worth US$124.1 billion announced in 2018, a 3.4 percent decrease by value compared to 2017. However, at US$120.5 billion, PE exit value reached its highest value on record.

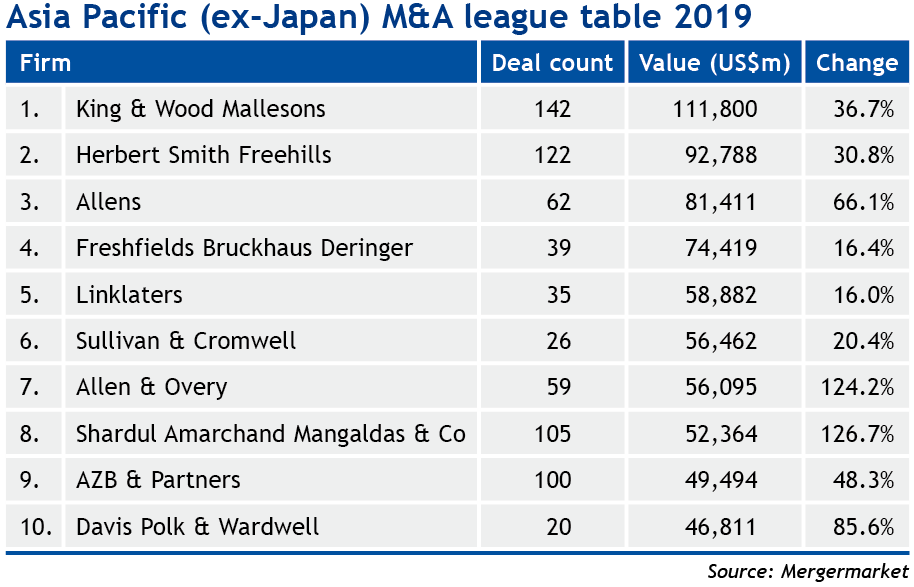

Looking at Mergermarket’s legal adviser rankings, King & Wood Mallesons tops the chart by both value and deal count, advising on 142 deals worth US$111.8 billion, followed by Herbert Smith Freehills and Allens.

Japan

In a record year, Japanese outbound M&A soared to unprecedented levels, led by two global deals that made it into the global top 10 for 2018: the US$26 billion Sprint-T-Mobile merger and Takeda’s US$80 billion offer for Shire.

As Japanese companies continue to focus on overseas growth amid a dwindling home market, there were 311 outbound transactions worth US$171.8 billion, with 25 deals in the billion-dollar bracket. This is the highest value in Mergermarket’s records, almost 50 percent above the previous record set in 2012.

In terms of Japanese targets, there were 444 deals in 2018, worth a total of US$46.8 billion, which was slightly higher than the value in 2017. The vast majority of these deals were entirely domestic, with just US$6 billion of inbound M&A, reflecting the low growth potential and high valuation of most Japanese companies. Activity picked up in the last three months of the year, with US$15.9 billion of deals across 100 transactions, accounting for an 8.1 percent share of Asian M&A.

Private equity suffered an almost total collapse, with the value of buyouts down by 86.9 percent to US$2.1 billion from 54 deals.

Fried Frank Harris Shriver & Jacobson advised on the highest value of Japanese deals, having played a role on five transactions with a total value of US$158 billion, while Mori Hamada & Matsumoto led the legal adviser rankings by deal count, having advised on 73 deals worth US$114.6 billion.

Click Here to read the full issue of Asian-mena Couddnsel: Mergers & Acquisitions Special Report 2019.

Click Here to read the full issue of Asian-mena Couddnsel: Mergers & Acquisitions Special Report 2019.