By Net Le

By Net Le

The implementation of public-private partnership (PPP) projects has been a widely popular solution for providing quality public services at a reasonable price. A PPP project proposal must be bankable and deliverable in light of current market circumstances. Approving a project that has no financial infeasible is not time- and resource-efficient. Therefore, the study of the structure and mechanisms of financing PPP projects is particularly important.

Project finance or corporate finance

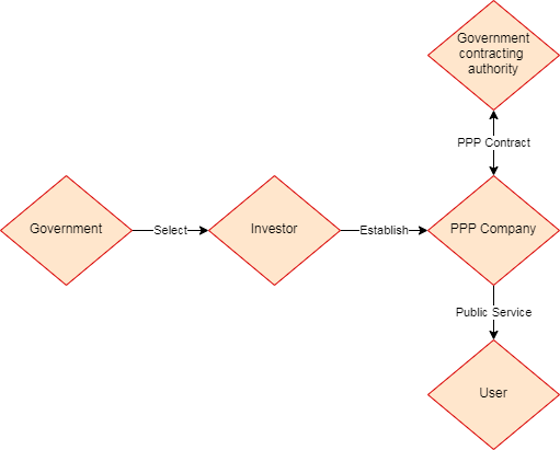

Under the current Draft PPP Law, PPP structure could be simply demonstrated as below:

The Draft PPP Law provides that private investors and PPP Company are responsible for contributing equity, mobilizing loans and other lawful capital sources to implement the projects. There are two (02) routes to raise fund from debt for PPP projects, namely corporate finance and project finance structures. The differences between these structures are summarized as below.

| No | Factor | Corporate finance | Project Finance |

| 1 | Borrower | PPP Company | Investor |

| 2 | Security | Assets of the Borrower | Assets of the Project |

| 3 | Basis of granting the loan | The current financial position, profitability and cash flow of the PPP Company. | Future cash flow of the project |

| 4 | Accounting effect | Increase the liability of the borrower | No effect on the liability of the borrower |

The benefit of corporate finance is that the cost of funding will be relatively lower than that of project finance. It is also less complicated than project finance. However, under Vietnam’s circumstances, corporate finance might lack feasibility when it comes to PPP projects. As shown in the above table, under the corporate finance structure, the lenders will wish to use the PPP Company’s assets as security for the debt. PPP Company is a Special-Purpose Vehicle (SPV) established after the PPP investor is selected, and has no asset other than the land that is assigned or leased to it by the Government. The problem is that although the Draft PPP Law allows the PPP Company to mortgage the land right and assets attached to land, they can only be mortgaged to Vietnamese credit institutions. As a result, offshore lenders will be reluctant to finance PPP Company because they do not have the right to take the project land as security. The regulation severely limits the fund-raising ability of PPP Companies.

From the international experiences, PPP projects are generally financed using project finance arrangements. Project finance refers to the provision of finance for long-term construction projects and public services using a non-recourse or limited recourse financial structure. In project finance, the lenders will rely on the projection of future cash flow generated by the project. It means that the debt used to finance the project will be paid back from the project’s future profit. This is in contrast with corporate finance where lenders rely on the borrower’s financial position as presented on the balance sheet to grant loans. For that reason, project finance is especially attractive to private investors who wish to invest in PPP projects.

Implication for Lenders

The top-tier loans provided by lenders, usually referred to as “senior debt”, form the substantial source of funding for the PPP Company. The rest of the required fund will be provided by sponsors in the form of subordinate debts. Commercial banks are crucial in infrastructure projects as they provide senior loans and guarantee products.

Because of the high level of complexity and duration of project-financed projects, commercial banks must be extremely cautious when entering into these projects. The lenders need to ensure that the project will produce sufficient cash flow to service the debt even when shortfalls in cash occur as a result of poor performance by the PPP Company or the PPP Company’s subcontractors. Additionally, they also need to ensure that senior lenders will have priority over subordinated lenders in access to future profit of the project. The higher the level of risk in the cash flows, the more extensive assessments and forecasts the lenders must conduct to ensure that the cash flow is reasonably sufficient to repay the loan.

In order to build an adequate safeguard, senior lenders must carefully apply measures to minimize their risks as far as possible. In practice, before entering into a facility agreement, the lenders will conduct an extensive due diligence on the potential viability of the project and prepare a detailed review of the project’s risks and protection mechanism. This is commonly known as project’s “bankability” assessment. A project is bankable if it is, in the lenders’ opinion, financially, economically, and technically sound. It means that the project protection mechanism is reasonably appropriate for the nature of the project, and credit risk is acceptable.

The lenders will also depend on forward-looking financia ratios “to assess project risk, and the variability of cash flows. The most commonly used ratio is “debt service cover ratio”(DSCR). If the DSCR is less than 1, the project does not generate any cash, which means that the borrower will be unable to cover or pay current debt obligations. If the DSCR is too close to 1, the project is vulnerable, and a minor decline in cash flow could make it unable to service its debt. It is desirable to have the DSCR greater than 1 as it shows that the project will generate sufficient income to pay its current debt obligations. Lenders commonly specify their requirement for a minimum level forward-looking annual DSCR. In most cases, lenders will require that the borrower maintains a certain minimum DSCR while the loan is outstanding. Some agreements will consider a borrower who falls below that minimum to be in default.

Conclusion

The PPP model is an effective solution to fill the gap between the demand for public infrastructures and the limited government budget. The selection of financing structures for PPPs needs to be carefully considered based on expected income, cash flow level and asset value of the project because PPP projects often involve large and long-term investments.