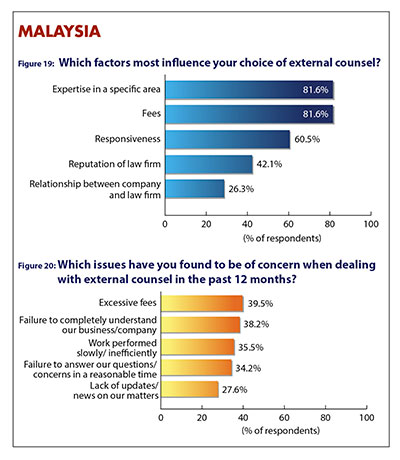

Malaysia’s In House Community, as it was last year, is foremost represented by those in the Financial Services sector (19.7 percent). Energy/Natural Resources, Manufacturing and Technology, Media and Telecommunications all narrowly missed out on top spot, each with 17.1 percent of respondents working in those areas. Real Estate/Construction in-house counsel too had a high rate of participation, at 14.5 percent. Team size A commanding majority (77.3 percent) said their in-house teams are likely to stay the same size over the coming 12 months, up from 50 percent in last year’s survey. One fifth of those asked believe their teams will grow, while the other 2.7 percent expect their team to get smaller over the next year. Increased business size and job demand led many of those anticipating growth to do so, with many requiring new expertise and extra hands on deck to take on upcoming work: “Legal and regulatory issues are the utmost concern for most of the financial institutions at this juncture, particularly with the huge penalty/fines imposed on institutions for non-compliance or contravention of laws, rules and regulations”. Meanwhile, cost-cutting and internal reorganisations saw some predict that their teams would shrink. Recruitment KEY ISSUES AND CONCERNS Many in-house counsel in Malaysia are in a struggle to “convince the business unit to look at the legal risk of [what they are doing]”. “Our commercial colleagues are unable to comprehend and understand the need to minimise legal risk vs their commercial profit [sic]”, another told us. Legal being perceived as a cost rather than an aid was also mentioned by others, and in the coming year, some see the issue of tackling more work with less resources as a cause for concern. Working with external counsel No one particular issue has stood out as a concern for in-house counsel in Malaysia when dealing with external counsel in the last 12 months, though excessive fees, according to 39.5 percent of those surveyed, is the main downside to external help; followed by failure to understand the company, a complaint held by 38.2 percent; work performed slowly, as stated by 35.5 percent; and failure to answer questions in a timely manner: a problem had in the past year by 34.2 percent of those asked. (Figure 20) Almost three quarters (73 percent) see no reason to adjust the degree to which they rely on external counsel in the coming year, while 16.2 percent expect to use them more often and 10.8 percent anticipate using their aid less. As well as a lack of adjustment in the volume of work they assume they will receive, the in-house counsel in Malaysia expecting no change in work undertaken externally said that though the load would likely increase, they were going to take on the extra bulk internally, with some claiming that they simply do not have the choice due to budget. Business expansion (some of which being overseas) and the requirement for specialised knowledge were the main reasons given by those expecting to use external counsel more, along with new regulations. In cases where in-house counsel said they would use private practice lawyers less, most pointed to a preference to handle matters in-house, though cost, as per usual, was a prevailant factor. <bBack to 9th Annual Representing Corporate Asia & Middle East Survey</b |

MALAYSIA

103

previous post