As well as noting key recent patent sales, Ronald Yu, General Counsel of Gilkron Ltd, discusses why it is important for in-house counsel to beware of IP laws, how with use of modern technology and specialised search engines this is now easier than ever and how a company’s trademarks can be worth more than its book value.

Companies are exploring new ways to exploit the value of their IP, supporting business strategies in many diverse and innovative ways, albeit sometimes under pressure from activist shareholders who have become increasingly intolerant of what they perceive as IP mismanagement by executives and directors1. For example:

- America Online (AOL) sold over 800 patents to Microsoft in April 2012 under pressure from an investor who had suggested that AOL’s patents were worth more than $1B on the market and

- BM recently transferred 750 patents to Twitter as part of a licensing deal and settlement of litigation.

There have also been high profile sales of IP including Ericsson’s sale of patents to Unwired Planet2 or Kodak’s sales of patents to Apple, Google and others.3

Not surprisingly, intellectual property (IP) value has emerged as hot topic fuelled by, among other things, a recognition that for many companies, IP is their most valuable asset class (for example, the Coca Cola trademark is worth more than the book value of the company4), record merger and acquistion (M&A) activity5,6, the promulgation of new IP valuation standards by various bodies7, new accounting standards requiring the reporting of IP8, increasing scrutiny by government officials of companies’ use of IP to avoid taxes9 and pressure from activist shareholders.

While there are established methodologies for valuing IP10, these schemes are limited11 not in the least because they overlook the true nature of IP, that as an intangible asset with business, legal, and in some cases, technological aspects, an IP right (IPR) cannot really be valued in the same way as tangible property – land, machinery, etc. – and also because they presume that there is actually a market for the IP which may not be the case. Moreover, just as the value of a used car may differ from the perspectives of the buyer and seller, the value of IP will vary depending on the underlying purpose of the valuation.

As IPRs are legal creations, in-house counsel really need to get involved in any IP valuation exercise to ensure the integrity of the work partly because non-legal valuers may not fully appreciate the subtle intricacies of IP (even though valuers are required to understand the “nature and attributes of the subject intangible asset”, reference is also made to “characteristics”, “attributes” and “functionality” of the subject asset12).

|

|

|

|

|

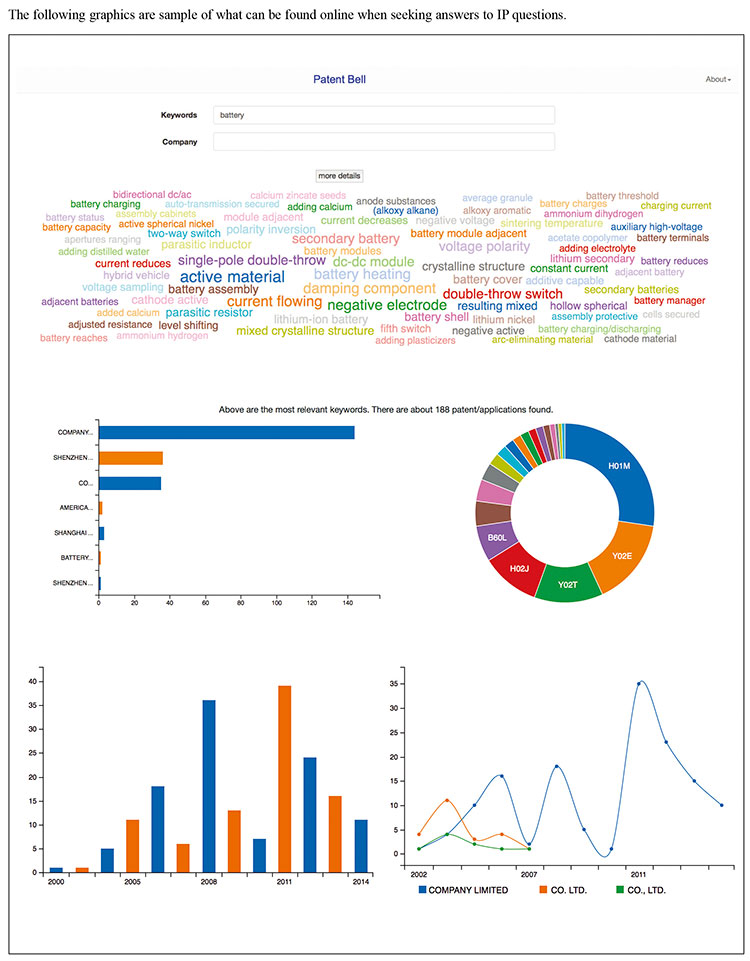

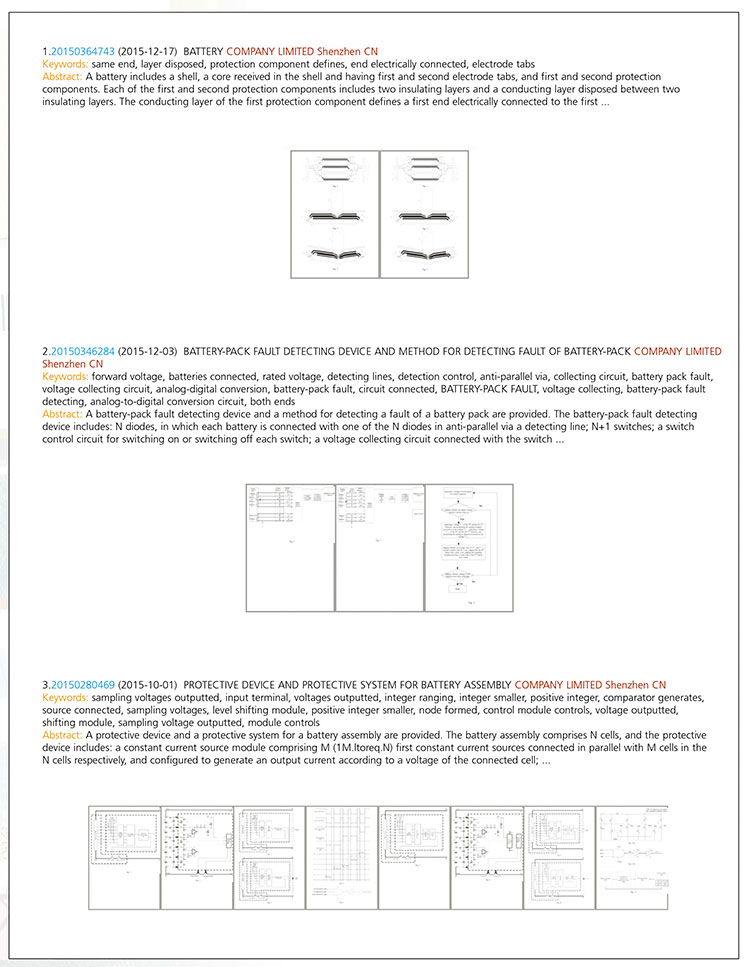

| Legally speaking As legal creations, IPRs can be invalidated administratively13, judicially and even legislatively – and, in many cases, would then cease to have much, if any residual functional utility (unlike, for instance, an abandoned house that is ostensibly worthless yet could still be used for shelter) and thus, value.The value of IP is also directly related to a company’s ability to exploit their IP –for instance, a company’s brand value (and thus the value of its trademarks) depends on the competence of its management to maintain and increase the goodwill in its brands. The ability of management to do so will depend on their appreciation of IP as a valuable asset and nowhere is the complexity of the value of an IPR more apparent than with patents. Patently clear

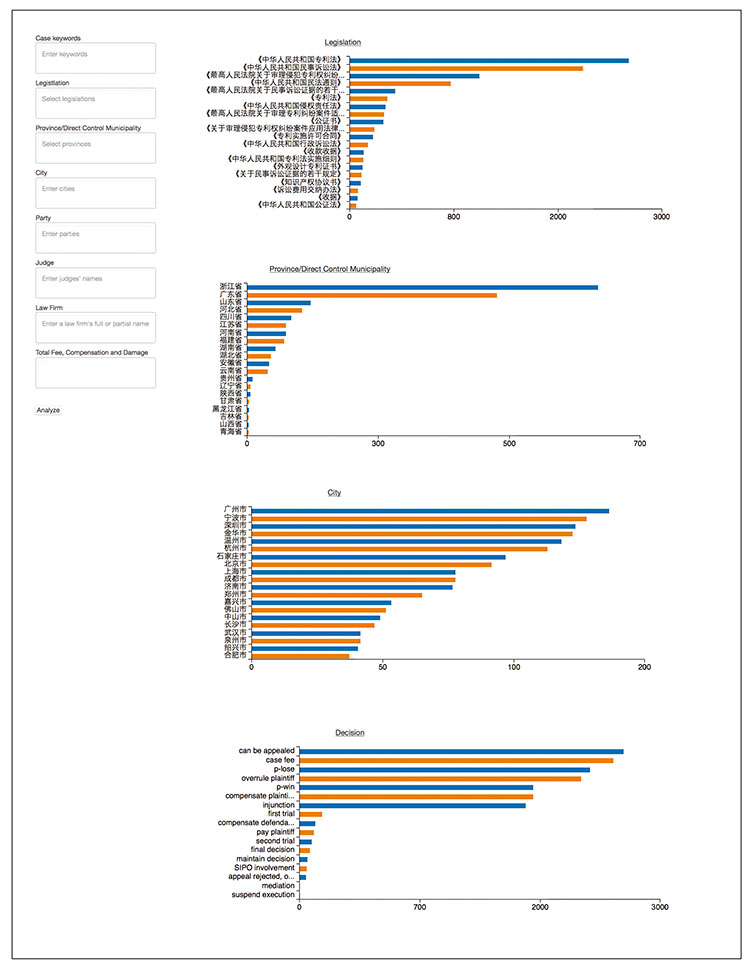

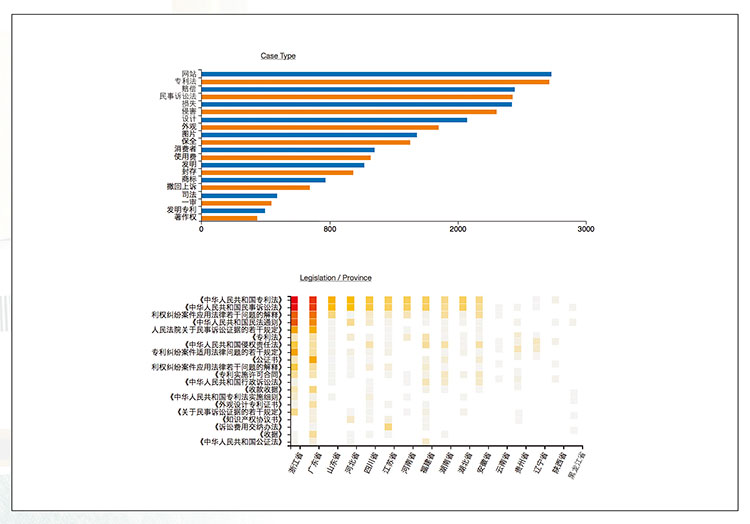

and though the first two may be readily quantifiable, the last one may not be. This presumes that the patent is technologically relevant and there are tools to help with the assessement (of technological relevancy) such as the one illustrated on previous pages which can display technologies related to a particular technology, major players in the space (which could both be potential buyers of the patent, the patented technology – or rivals) and applications. Enforceability is also important and this will depend not only on relevant local enforcement bodies , but also litigation risk that, in turn, relates to the quality of counsel, assessments of the experience of local courts and judicial personnel and the likelihood of favourable outcomes. Thanks to big data and open data sources, tools that can provide such insights exist today that, surprisingly, can provide valuable judicial insights in places like China (see relevant graphics). Thus the value of an IPR can be difficult to assess in part because any valuation of an IPR must acknowledge the underlying legal aspects of that IPR. However, thanks to modern technology, tools exist to help counsel make such evaluations. _______ Footnotes:

|

| Email: ron.yu@gilkron.com Website: www.inhousecompliance.com |