8F, Kerry Parkside Office,1155 Fang Dian Road, Shanghai 201204, P. R. China

Tel: (86) 21 50101666*990 / Fax: (86) 21 50101222

E: kevin.xu@mhplawyer.com • franz.li@mhplawyer.com

W: www.mhplawyer.com

In January 2017, Apple sued Qualcomm in Beijing Intellectual Property Court over the abuse of its dominant market position.

In January 2017, Apple sued Qualcomm in Beijing Intellectual Property Court over the abuse of its dominant market position.

Apple alleged that Qualcomm abused its market dominance when licensing telecommunication standard-essential patents (SEPs) and selling baseband chipsets. Specifically, it complained that Qualcomm charges unfairly high royalties for licensing SEPs and sets unreasonably strict conditions for Apple to obtain the licence of SEPs; Qualcomm refuses to license SEPs to some SEP users; furthermore, Qualcomm restricts Apple to use exclusively the products/services it supplies or approves to use, etc. Therefore, Apple requested Qualcomm to compensate for its economic loss in the amount of Rmb1 billion. One week before this case, Apple also filed a US$1 billion lawsuit against Qualcomm in the US for the same reasons.

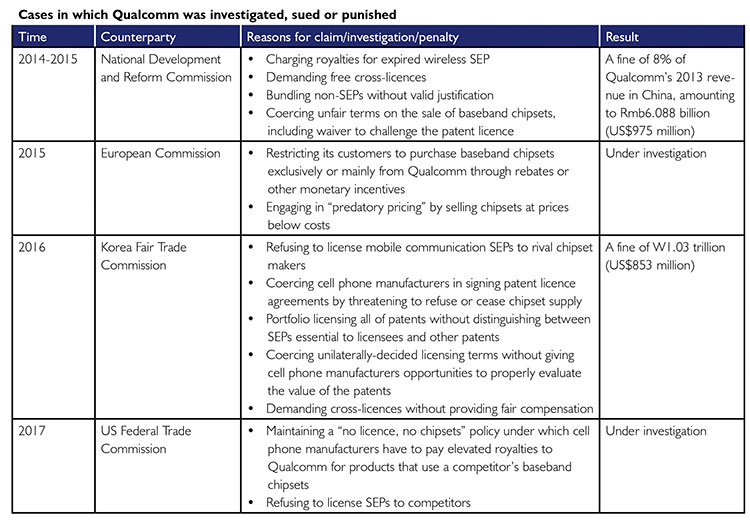

As one of the world’s biggest baseband chipsets manufacturers, Qualcomm owns numerous mobile communication SEPs and is in a dominant position in the mobile communication SEP markets and baseband chipsets markets of relevant countries. In fact, in 2015, Qualcomm received a large fine imposed by China National Development and Reform Commission for violation of Anti-Trust Law. Meanwhile, Qualcomm was also investigated, sued or punished for abuse of its dominant market position in other jurisdictions, including the US, South Korea and the EU.

These cases demonstrate that Qualcomm was punished or investigated in these countries for its worldwide business model, which, generally speaking, is to coerce or induce the handset makers to choose its baseband chipsets by means of bundling patent licensing into chipsets sales complemented by rebates or other monetary incentives, through using its dominant market position, and bundling patents, tie-in sales and forced cross-licence, etc.

This lawsuit brought by Apple is partly due to the fact that Qualcomm induced Apple to sign an exclusive agreement by granting rebates and because Apple provided its cooperation to the Korea Fair Trade Commission in its anti-trust investigation against Qualcomm. The dispute between these two large companies put Qualcomm into the spotlight again. It is so far reaching in terms of its impact on the industry that not only Qualcomm and Apple themselves, but also anti-trust enforcement authorities and even other baseband chipset or cell phone manufacturers in this industry may be brought into the case. Therefore, we are paying close attention to the progress of this case and will analyse the case from the perspective of facts and laws in the next article.

蘋果中國起訴高通,高通再次涉嫌濫用市場支配地位?

2017年1月,北京知识产权法院受理了苹果电子产品商贸(北京)有限公司(”苹果公司”)诉高通公司、高通技术公司、高通无线通信技术(中国)有限公司、高通无线半导体技术有限公司(统称”高通公司”)滥用市场支配地位及标准必要专利实施许可条件纠纷两案。在滥用市场支配地位一案中,苹果公司主张高通公司在进行相关通信标准必要专利的许可及基带芯片销售时存在滥用市场支配地位的行为,具体包括:高通公司收取的标准必要专利许可费用及向苹果公司发出的许可条件过高;拒绝向某些标准技术实施者提供许可;限定苹果公司使用其提供的或批准使用的产品/服务等。因此,苹果公司要求高通公司赔偿其10亿元人民币的经济损失。而在该案公布的一个星期前,苹果公司也以相同理由向美国法院起诉高通公司,索赔10亿美元。

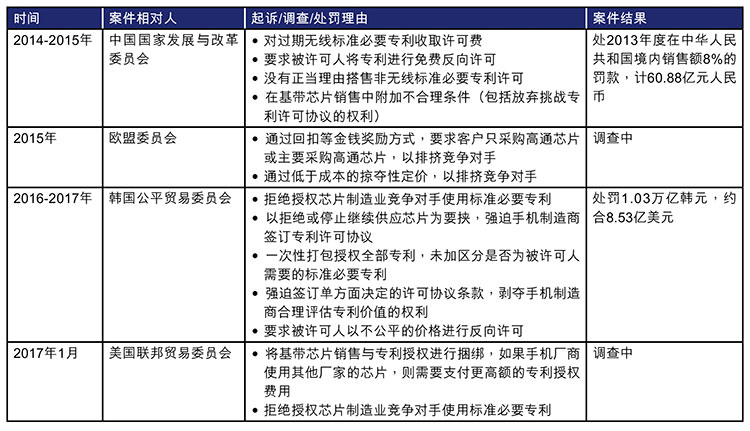

高通公司作为全球最大的基带芯片生产厂商之一,持有众多移动通信标准必要专利,在相关国家移动通信标准必要专利市场和基带芯片市场具有市场支配地位。事实上,早在2015年,高通公司就因为违反中国《反垄断法》而遭受了中国国家发展与改革委员会的巨额罚款,并且在其他国家和地区,如美国、韩国以及欧盟,高通公司都曾因滥用市场支配地位的行为被调查、起诉或处罚。本文总结了近些年来高通公司因滥用市场支配地位行为被各国(地区)调查、起诉或处罚的情况如下:

从以上案例可以看出,高通公司在各国被处罚或被调查都缘於其在全球范围内普遍采取的商业模式。总结说来,即是利用市场支配地位将专利授权与芯片销售相捆绑并结合回扣等金钱奖励方式,强迫或诱使下游手机制造厂商选择其基带芯片产品;同时包括打包授权专利、搭售以及强制反向授权等。

此次苹果公司的发难也与之前高通公司利用回扣方式要求苹果公司签署排他性协议以及苹果配合韩国公平贸易委员会对高通公司开展调查有关。而两家行业巨头的反目再一次将高通公司推向了风口浪尖。无论是高通公司与苹果公司自身,还是各国的反垄断执法部门乃至行业内其他基带芯片制造商或手机厂商都不能仅作为旁观者看待这一案件。因此,我们也在密切关注事件的进展,并将在下一篇文章中从事实和法律两个角度对本案进行更深入的论述与分析。