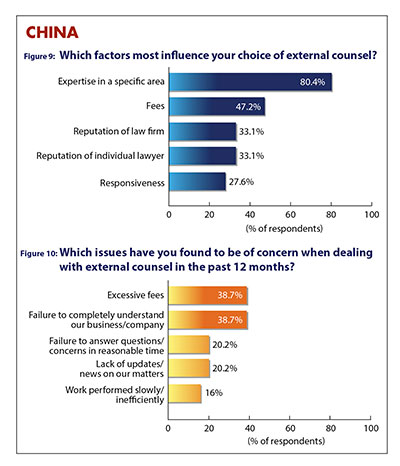

This year’s surveyed In-House Community in China was once again represented by those in the Manufacturing industry more than any other (31.3 percent). Technology, Media & Telecommunications took second with 18.4 percent, Financial Services, with 11 percent, took third, while Energy/Natural Resources (which usually places higher) was this year’s fifth most-represented industry amongst the participants with 7.4 percent, just behind Life Sciences with 9.2 percent. Team size Similarly to last year, in the coming 12 months, the majority (65 percent) of in-house counsel in China anticipate their in-house teams remaining the same size. The second most popular response was that they expect the team to grow, with 31.9 percent believing this, and the rest (just 3.1 percent) foresaw their team shrinking over the next year. Saving on cost and no requirement for expansion due to either no new projects in the works or a stable business need were the most popular reasons for foreseeing an in-house team’s size continuing as is. Among the main reasons people predicted growth were increased risk and increased business. A requirement to improve compliance was also cited. Increased efficiency and aid no longer being needed were reasons for expected team shrinkage, along with a lack of suitable replacements for departing employees. Recruitment KEY ISSUES AND CONCERNS Managing the balancing act between business and compliance, especially when the legal function is seen as a hindrance rather than an aid by the business, is also still an issue for many. According to one respondent, “Ensuring the business is running in compliance with the law [whilst] observing local practices” makes their task more taxing, while another noted that “Making sure [their] employees comply with the law [whilst recognising] local culture”, along with “Inconsistency and uncertainty of enforcement” are issues. Complying with “contradicting US and China laws”, and in the words of another “connecting with European and US laws” were among the comments that shed light on the more international role in-house counsel in China increasingly fulfill. Other respondents stated that finding quality support, both in terms of good external counsel and competent junior in-house counsel, was a major concern. Working with external counsel Budget constraints was a recurring response from participants when asked why they felt that they would either use external counsel less or the same amount in the coming year. Increase in business size and therefore in demand for legal support was the primary reason in-house lawyers said they would use more outside help, along with entry into new areas and therefore the requirement of a more diverse range of expertise. Above all else, expertise in a specific area (at 80.4 percent) is by far the main reason surveyed in-house counsel choose one law firm over another. Other popular reasons for going to one external counsel over another include fees at 47.2 percent; reputation of a lawyer or law firm, each with 33.1 percent; and responsiveness, which is a main consideration for 27.6 percent of respondents. (Figure 9) Whereas last year, excessive fees was the sole number one reason for concern of in-house practitioners in China when dealing with outside counsel, this year it came joint first, along with external counsel’s failure to understand their business, at 38.7 percent. This may signify a more demading in-house clientele as much as an area of increased concern. Lack of updates (20.2 percent) and work performed slowly or inefficiently (16 percent) were also noted as drawbacks. (Figure 10) |

CHINA

36

previous post