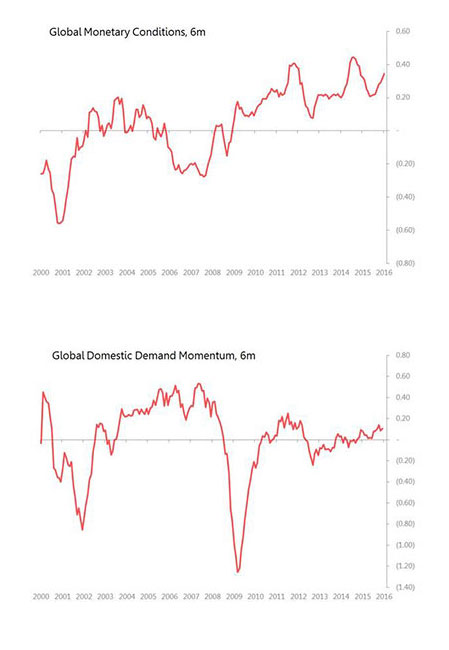

It’s common to hear that the most dangerous words in economics are ‘it’s different this time’. But ‘it’s just the same as last time’ run them a close second: each economic or financial crisis develops in its own way, and follows its own trajectory. If today’s financial volatility does mutate into an economic crisis, it will have very different roots from the crisis of western financial institutions of 2008, the US-led recession of 2000 or the Asian financial crises of 2007/08.The differences are so pronounced that it’s surprising that the consensus that economic chaos is heading our way has been so easily accepted. This is where it pays to crunch quite a lot of data, rather than rely on excitable headlines or ‘gut feeling’. First, compare the difference in global monetary conditions currently developing to the situation in previous recessions. (I’m tracking them here for the US, China, Japan and the Eurozone by measuring how much money is out there, what’s the price of it, the shape of the yield curve, the size and volatility in changes in international price of different currencies). Prior to the onset of recession in the US in mid-2000, global monetary conditions had been deteriorating for at least a year, with US short term rates bottoming in Oct 1998 at 4 percent, rising to over six percent by the time recession bit. Before the financial avalanche of 2008, global monetary conditions had been in solid deterioration for approximately two and a half years. Between 2004 and the middle of 2007, US short-term rates had risen from approximately 1.5 percent to a peak of five percent in mid-2007. One could argue that both in 2000 and 2008, the US Federal Reserve was working to cool things down, and eventually succeeded beyond their most fevered nightmares. Global monetary policymakers are not (yet) making the same mistake this time. True, the Federal Reserve has tapped the brakes, but this continues to be offset by easing in China, the Eurozone and Japan. |

Demand conditions are also very different from the onset of previous recessions. (My measurement here aggregates 30 different monthly measures from the US, Europe and NE Asia, with the common components being employment, retail sales and auto sales. In each case, I measure each to see how far they are deviating from a long-term seasonalised trend.) Prior to both the 2000 and 2008 recessions, global domestic demand was running quite sharply stronger than underlying trend. Not now: since early 2013 global demand has shown, at best, a tortuous but persistent upward grind.Nor is it difficult to discover the reason: the world’s banks remain loathe to lend, so it’s difficult to spot a vigorous credit cycle anywhere (with the possible exception of South Korea). With no credit boom kicking in to accelerate the cycle, the current global expansion depends largely on the slow rise in employment in developed economies. But this is where the good news lies:

Normally, economists view employment as a lagging indicator, because small upturns in business conditions tend to be accelerated into fully-blown business cycles by supporting credit and investment booms, which in turn accelerate the rise in employment. When the credit and investment music stops, it takes some time for labour markets to react. But the single most salient feature of the current global expansion is precisely the absence of credit and investment booms. Those bubbles aren’t about to burst, because they’ve not yet been blown. So for the time being, the rise in employment is likely to backstop global economic growth, even if collapsing stockmarkets temporarily knock consumer confidence, depress retail sales and raise savings ratios. If these don’t form the roots of the next financial crisis, what is the problem which Asia’s falling stockmarkets are reacting to? Next time. . . dollar strength and Asian finance. Michael Taylor runs Coldwater Economics, a consultancy serving institutional investors worldwide since 2009. Michael spent 15 years of his career in Asia, principally Hong Kong and Tokyo, as Asia economist for Morgan Stanley and chief economist for W I Carr. He offers a daily Shocks & Surprises services which tracks approximately 450 economic data releases each month, identifying and briefly explaining those which deviate significantly from consensus or trend. For more information: |