By Danielle Lobo and Imran Asghar

|

The Authors

Danielle Lobo Danielle is a corporate/commercial lawyer with considerable experience in a wide range of corporate matters including private equity transactions, mergers and acquisitions, joint ventures, restructurings and reorganisations. She advises vendors, trade purchasers and management on both the sale and purchase of companies, as well as on private equity investments. Danielle is a member of the Law Society of Scotland. She holds an LLB (Hons.) from the University of Aberdeen, Scotland.

Imran Asghar Associate iasghar@afridi-angell.com Tel: +971 4 330 3900 Imran’s practice focuses on corporate and commercial law, as well as mergers and acquisitions. He advises clients in domestic and cross border transactions in connection with acquisitions, divestitures, and corporate restructuring matters. Imran is a member of the Pakistan Bar Association. He holds an LL.M. from the University of Warwick and an LL.B. from the University of London. |

Introduction

The latest in the series of insolvency regime reformations in the Middle East is the new Dubai International Financial Centre insolvency law; DIFC Law 1 of 2019 (the New Law). Subject to article 1(4) of the New Law, the New Law repeals and replaces DIFC Insolvency Law 3 of 2013 (the Old Law). Article 3 of the New Law states that it applies in the jurisdiction of the DIFC, meaning that it applies to all DIFC incorporated entities. The New Law will come into force on 28 August 2019.

The New Law combined with the expanded and restated Insolvency Regulations aims at encouraging trade and investment in the UAE by bringing the DIFC in line with international best practice in cases of insolvency. The New Law generally follows the same principles as UAE Federal Law 9 of 2016 on Bankruptcy in so much that it offers a formal restructuring procedure as a rescue tool to debtors, provides a mechanism for binding non-consenting creditors and, generally, promotes a more structured and effective system for businesses in financial distress.

The New Law provides significant additional restructuring options to debtors and creditors. While offering additional protection and tools to debtors willing to rescue their businesses by way of restructuring, the New Law ensures that these protections and tools are balanced with the rights offered to creditors to recover their debts.

What is being offered?

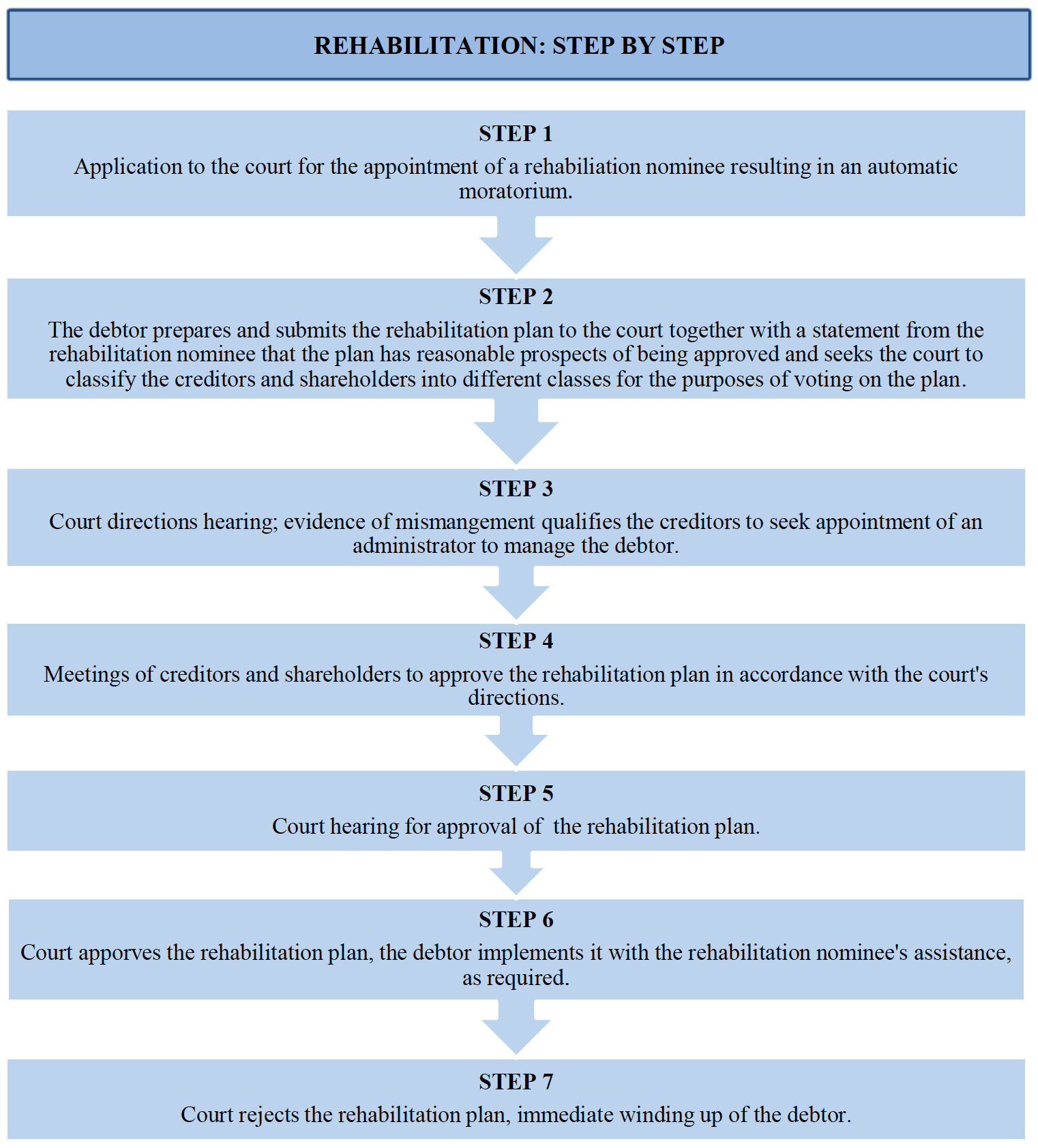

Rehabilitation: the New Law provides for a court supervised debtor in possession regime called ‘rehabilitation’ which essentially allows a debtor an opportunity to rescue its business by way of proposing a rehabilitation plan to its creditors and shareholders for their vote. A debtor is entitled to apply for rehabilitation if it is, or is likely to become, unable to pay its debts and if there is reasonable probability of reaching a mutually agreeable arrangement with its creditors and shareholders.

One key feature of the New Law, and one that will surely be welcomed by financially distressed businesses, is that from the time that a debtor makes an application for rehabilitation, an automatic moratorium is immediately applied to all its creditors (secured and unsecured) for a period of 120 days. Amongst other things, the automatic moratorium affords debtors certain protections against termination of contracts. With the intention of creating a balance between the protections afforded to debtors and creditors, the New Law allows creditors to apply to the court seeking relief from the moratorium.

The New Law provides that for the purposes of voting on the rehabilitation plan, creditors and shareholders will be categorised into different classes with the court’s consultation. In order to be implemented, the plan needs to be approved by at least 75 per cent of the creditors or the shareholders in each class as well as the court. This essentially allows for binding the minority dissenting creditors and shareholders in each class to the rehabilitation plan.

The New Law grants courts the overriding power to sanction the rehabilitation plan provided that: (a) at least one class of creditors affected by it has accepted the plan; (b) all creditors are receiving at least as much value as they would have if the debtor was wound-up; and (c) a junior creditor in a class of creditors does not get paid before a senior dissenting creditor in that class.

Another significant relief that the New Law provides to debtors during the rehabilitation process is the ability to take on court sanctioned new financing (secured or unsecured).

Court appointed administrator: in the event that there is evidence of mismanagement and misconduct, one or more creditors can make an application to the court for the appointment of an independent administrator to manage the affairs of the debtor during the rehabilitation process. If appointed, the administrator will have the power to: (a) approve the rehabilitation plan; (b) facilitate a company voluntary arrangement; (c) approve a scheme of arrangement under the Companies Law; and (d) investigate any misconduct and mismanagement by the debtor and its management.

Cross-border insolvency: another important feature of the New Law and one that should provide a great deal of confidence to the international trade community when investing in the UAE is the adoption of the United Nations Commissions on International Trade Law (UNCITRAL) Model Law. This will essentially ensure the mutual co-operation and co-ordination of cross-border insolvency proceedings.

Other enhancements: the New Law amongst other things also: (a) improves on the voluntary and compulsory winding up procedures offered by the Old Law by streamlining the appointment process for the appointment of a creditors’ committee in a winding up and clarifying the process for dissolution; (b) provides additional provisions governing unlawful trading and the reuse of company names; and (c) creates an offence of misconduct in the course of winding up.

Conclusion

The New Law introduces many welcomed features which should place the DIFC at the forefront of jurisdictions with developed and sophisticated insolvency regimes and is certainly a step forward in maintaining the UAE’s position as a world leading trade hub. ■

| Afridi & Angell

Founded in 1975, Afridi & Angell is a full-service UAE law firm in its fifth decade at the forefront of the legal community. From the beginning, our hallmarks have been a commitment to quality, unsurpassed knowledge of the law and the legal environment, and crafting of innovative business solutions. Licensed in the three largest Emirates of Abu Dhabi, Dubai and Sharjah as well as the Dubai International Financial Centre, our practice areas include banking and finance; corporate and commercial law; arbitration and litigation; construction; real estate; infrastructure projects; energy; project finance; maritime (wet and dry); and employment. We advise local, regional and global clients ranging in size and sophistication from start-ups, sole proprietorships, family-owned businesses, entrepreneurs and investors to some of the world’s largest public and private companies, governments and quasi-government institutions. We attract and retain clients with our dedication to practical guidance focused on their business needs supported by decades of experience here in our home jurisdiction, the UAE. Afridi & Angell is the exclusive member firm in the UAE of top legal networks and associations, most notably Lex Mundi, the world’s leading network of independent law firms, and World Services Group. |

| Afridi & Angell’s inBrief provides a brief overview and commentary on recent legal announcements and developments. Comments and opinions contained herein are general information only. They should not be regarded or relied upon as legal advice.

© 2019, Afridi & Angell |