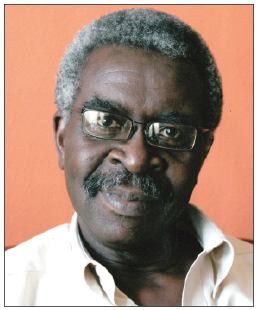

Contact: Kojo Bentsi-Enchill

Contact: Kojo Bentsi-Enchill

Written By: Araba Attua-Afari and Patience Emieaboe

In line with the national push for a more structured approach to increasing local content and participation, the Regulations came into force on 22 December 2017. Prior to the passing of the Regulations, only the general local content provisions set out in the Ghana Investment Promotion Centre Act, 2013 (Act 865) applied to the electricity supply industry.

Establishment of Electricity Supply Industry Local Content and Local Participation Committee (the “Committee”) – The Committee established by the Regulations to oversee the development and of local content and participation in the industry, and to monitor the implementation of the Regulations was inaugurated on 2 May 2019.

Ghanaian equity participation – The levels of local content for certain activities in the electricity supply industry range from an initial 15 percent to 80 percent, rising to between 49 percent and 100 percent. Service providers operating in the industry before the coming into force of the Regulations have five years from the date of the Regulations to comply with the relevant initial level. All other service providers must be complaint with the initial level requirements from the commencement of the activity.

Restrictions on the transfer of interest / equity – With certain exceptions (such as a company engaged in manufacturing), the rights and interests of a Ghanaian citizen under a contract, and the equity stake in a company, in the electricity supply industry may only be transferred to a Ghanaian.

Partnership – A foreign company must partner with an indigenous Ghanaian company to provide goods and services. The levels of participation are set out in the Regulations.

Registration of service providers – All service providers in the electricity supply industry must register with the Committee by 22 March 2018.

Exemptions – The Regulations allow for local content exemptions for the provision of engineering and of technical consultancy and maintenance services. The exemptions apply where (i) proprietary equipment or technology is needed; or (ii) the service provider or any other entity engaged in any activity in the electricity supply industry can show that the expertise required does not exist locally.

Incentives – Tax incentives are available to a company that establishes a plant to manufacture or assemble electrical equipment or electrical appliances, or to manufacture renewable energy.

Penalties – The penalty for breach of the Regulations are, for a first offence, a fine of up to GHS 6,000 or to or to a term of imprisonment of between one and two years. Subsequent offences attract a fine of up to GHS 12,000 or a term of imprisonment of between six months and two years.

Whilst the rationale behind the passing of the Regulations is commendable, the current form of the Regulations raises concerns. For instance, the impact of the equity transfer prohibition on the attractiveness of Ghanaian power projects to foreign sponsors cannot be ignored. In light of the restrictions on the transfer of local equity, lenders must now reconsider the suitability of their security packages as a charge over Ghanaian-held shares of the project company can only be transferred to another Ghanaian. The prohibition also imposes a fetter on a Ghanaian company’s ability to exit the electricity supply industry when there is no willing Ghanaian buyer. The unfortunate result being a foreign sponsor who is tethered to an uninterested local partner.

____________________________

LEX Africa is an alliance of law firms with over 600 lawyers in 24 African countries formed in 1993. More information may be found at www.lexafrica.com.

E: kojo.bentsi-enchill@belonline.org

T: (263) 4 702 561