One clear sign that the Covid-19 crisis may have been both less impactful than first feared and also now ending is that mergers and acquisition (M&A) activity is returning to normal in the Asia Pacific.

A year ago, most businesses were contemplating the frighteningly uncertain prospect of what to do if the pandemic continued in 2021. Many Asia Pacific companies simply decided to push on as normal and either begin new M&A deals or finalize those that were set on pause.

According to EY, in the first half of 2021 M&A values in the region increased to US$535 billion, up from US$284b in the same period in 2020, The region has counted more than 50 deals valued over US$1b so far this year, an increase of almost five times year-on-year.

The EY report pointed to the technology sector as the leader of M&A deal activity, accounting for a third (28%) of the cumulative deal value in the first half of 2021, with deal value increasing by 88% year-on-year. The advanced manufacturing and mobility sectors were also active this year.

According to a Mergermarket report, in 2020 Asia Pacific M&A deal volume decreased by a nominal 4%, compared to the global decline of 14%. The report said rising consumer confidence led these trends and the region retains a positive GDP outlook.

Eversheds Sutherland Head of International M&A Asia Charles Butcher said the pandemic in 2020 had an obvious activity-suppressing impact early on with many investors adopting a precautionary, “wait and see” approach regarding M&A activity.

“By the second half of 2020 we were already seeing the market adapting in terms of deal mindset which, combined with recognition that the pandemic was helping to catalyse new opportunities, meant a generally strong finish to the year. The full 2020 year ended up being a lot better than most predicted,” he said.

While well-advanced projects were generally able to progress last year, many early-stage deals were delayed or suspended indefinitely. Originating new deals was challenging – particularly in Asia where relationships and face to face meetings are so important – but by 2021 this had become less of a barrier as deal-makers adapted and found different ways to interact, Butcher said.

Asia Pacific will be the centre of gravity for M&A for the near future – source: 2021 EY Global Capital Confidence Barometer survey

But the region isn’t out of the frying pan yet. The 2021 EY Global Capital Confidence Barometer survey of more than 2400 C-suite executives globally shows nearly half of respondents expect it will take until 2022 before revenues return to pre-pandemic levels.

However, an overwhelming 90% of these senior executives expect significant growth opportunities within Asia Pacific in the next three years. Companies in the region express an eagerness for M&A, with 53% of respondents saying that they are actively planning to pursue acquisitions in the next 12 months.

“As the initial shock of Covid-19 subsided, Asia Pacific senior executives pivoted, conducting comprehensive strategic portfolio reviews to reimage their competitive position. Now, they are seeking to rev up their M&A and transformation programs as they look to reshape their future in a post-pandemic world,” the EY survey said.

Private equity and tech companies

The trends are positive for another reason: there is still a lot of private equity capital looking for a home, desperate to find options with good returns on investment.

A report by EY found that PE now represents 30% of the M&A market, surpassing its prior peak of 25% in 2006. Throughout the first three quarters of 2021, PE firms were involved in US$868b worth of acquisition deals globally, “putting the industry well within striking distance for its first trillion-dollar year on record,” EY said.

Eversheds Sutherland M&A partner Rod Lai said PE continues to play a significant role in M&A activity in the Asia Pacific with record levels of “dry powder” on hand and ready access to low interest financing.

“Early in the pandemic many PE houses cautiously focused on portfolio management and protection rather than new deals. In the first half of 2021, Asia Pacific-focused PE funds raised more than US$80b, boosting the value of PE driven M&A transactions to a record US$102b,” Lai said.

PE activity has been particularly prominent in the technology and healthcare sectors. Technology mergers and acquisitions, for example, accounted for about 25% of deals by value and 30% of deals by volume over the last twelve months.

Impressive deals inked in only Q2 of 2021 – Source: S&P Global Market Intelligence

Lai explained this M&A focus on technology reflects the increasingly normal “stay-at-home” working lifestyle that has provided new opportunities for companies in media streaming, gaming, food delivery, e-commerce, virtual banking and digital currencies.

“Another factor is that traditional corporates see technology as an accelerated path to achieving transformative change within their own organizations,” he said.

Eversheds Sutherland Shanghai Office managing partner Jack Cai added that many technology M&A plays in traditional industries also align well with ESG (environment, social and corporate governance) considerations, which are increasingly important for every firm.

For instance, the automotive sector sees a natural alignment with the Chinese market to leverage the sector’s existing manufacturing capabilities to encourage rapid transition from fossil fuel engines to electric vehicles (EVs). Hence why China already accounts for more than 40% of global EV sales.

“These are a few of the vectors favoring technology deals and we expect the current high deal volume level to continue in the near term,” Cai said.

SPACs, ESG and government stimulus, oh my!

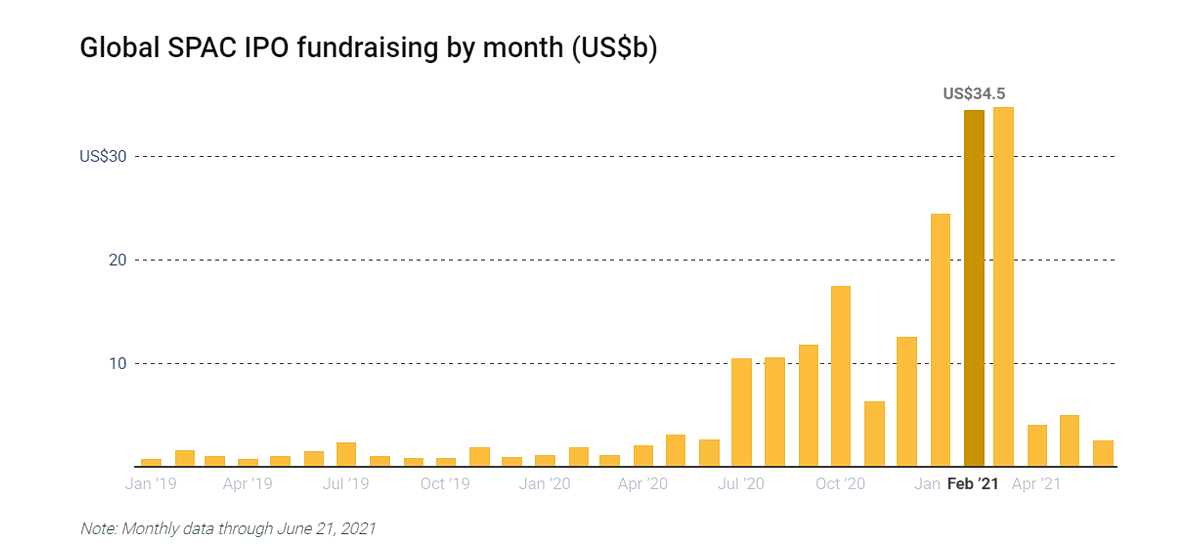

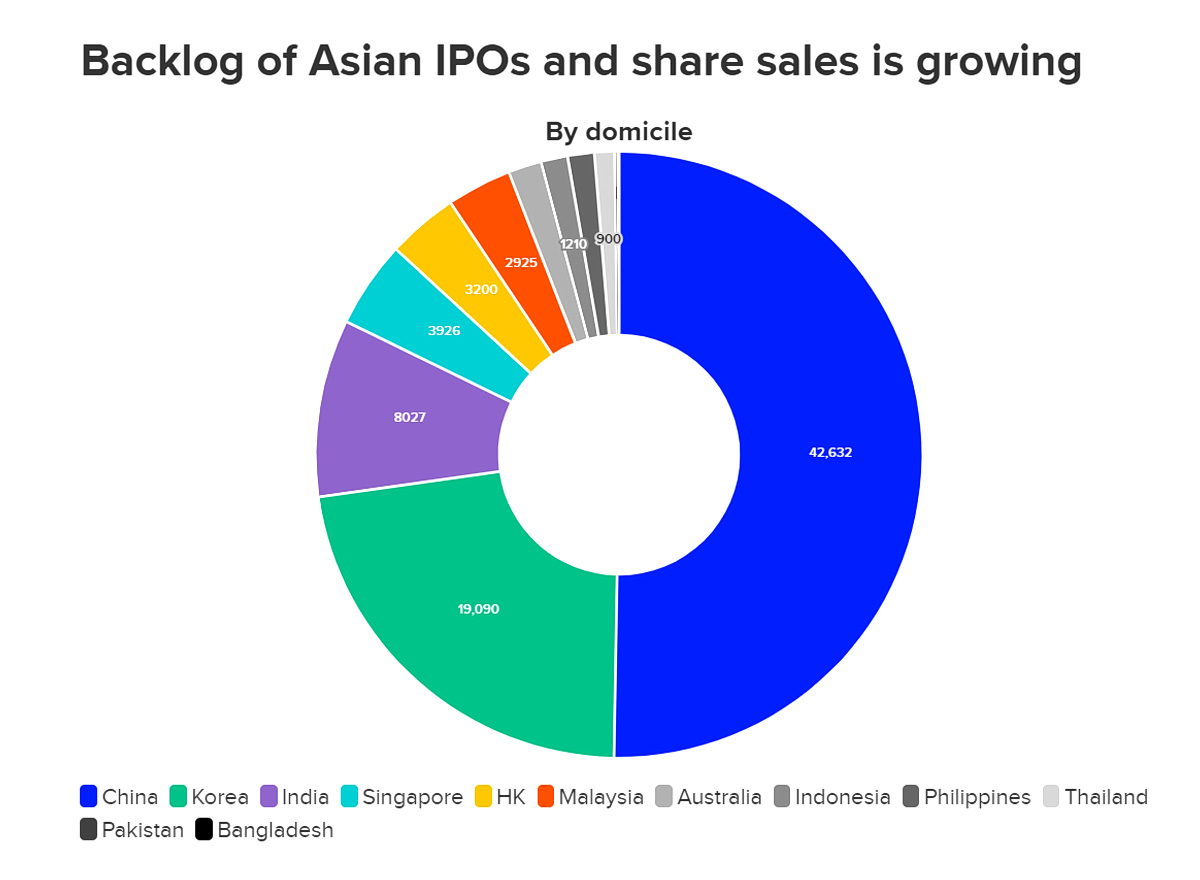

Special purpose acquisition companies (SPACs) are also more prominent in global deal activity through their sheer number and value of funds raised, in particular in the US. However, their overall impact on Asian markets, at least volumetrically, remains relatively limited.

A SPAC is a company with no commercial operations and is formed strictly to raise capital for M&A activities through an initial public offering (IPO). Also known as “blank check companies,” the popularity of SPACs has risen in recent years.

In 2020, 247 SPACs were created with US$80b invested, and in just the first quarter of 2021, a record US$96b was raised from 295 new SPACs. By comparison, only two SPACs came to market in 2010.

While some of the SPAC enthusiasm in the US has waned, Butcher expects that as suitable North American targets become more difficult to find (and/or valuations overheat) some US-based SPAC sponsors will look more closely at potential Asia Pacific targets and SPACs may therefore feature more frequently in regional M&A transactions.

He said Asia Pacific exchanges are also looking to promote their own SPAC regimes.

“The Singapore Exchange was first out of the blocks and will look to capitalize on the flourishing Southeast Asian start-up ecosystem. The Hong Kong Stock Exchange’s recent accelerated consultation process also suggests its SPAC listing regime may not be far away either, albeit likely with some different features to that of other markets,” Lai said.

He added that SPACs can provide interesting alternative exit options for early stage, pre-profit but high-growth companies in the Asia Pacific.

As with other parts of the world, government stimulus packages were widely adopted in the Asia Pacific region to help keep struggling companies afloat during lockdowns and travel restrictions, particularly in infrastructure, health, education, tourism, aviation, social protection and other sectors.

For example, Japan’s government approved an eye-popping ¥108 trillion (US$990b) package – worth about a fifth of its GDP. The US also passed a stimulus package of US$2 trillion, worth about 10.5% of its annual output.

Singapore’s total stimulus now stands at S$60 billion (US$41.7b), or 12% of its GDP. Malaysia topped up its previously announced RM250 billion (US$57.4b) stimulus with a further 10 billion ringgit. Thailand added a ฿1.9 trillion (US$58 billion) package – worth about 9% of GDP. And Indonesia will add Rp436.1 trillion (US$26.36b) worth of economic stimulus measures valued at 2.5% of its GDP.

Butcher said it is difficult to assess the overall impact of government stimulus plans on M&A activity since these programs are still playing out.

The appetite for additional SPAC deals remains strong in Asia – Source: Refinitiv

And although the nature and scale of stimulus measures have varied across the Asia Pacific (and globally), the general willingness of most governments to adopt some creditor support measures, combined with lender reluctance to call defaults and take early enforcement action, has helped suppress the level of distress-driven transactions, he said.

“Broader stimulus measures have helped maintain overall business confidence, alleviating some systemic risk and providing justification for deal-makers willing to bet on the speed and shape of recovery,” Butcher said.

“However, we are now seeing greater willingness among lenders to enforce and as stimulus packages and other creditor protective measures fall away we expect to see more distress-driven transactions.”

Outlook for 2022

For Asia Pacific as a whole, the long-term outlook is “incredibly strong,” Butcher said.

“Asia remains the most populous and economically dynamic region in the world. While there is material intra-regional variance, growth rates will continue to demonstrate sustained outperformance relative to most other regions,” he said.

Butcher added that while China’s perennially outsized economic growth rates have naturally tapered in recent years as its economy matures, those rates remain relatively high by comparison to other regions and the country’s sheer scale of the China market means it will continue to attract a disproportionate share of M&A deal activity.

“Meanwhile, shifting regional investment and supply chain dynamics, together with geopolitical challenges, will also drive significant ‘rest of Asia’ opportunities – in particular emerging markets in Southeast Asia,” Butcher said.

APAC equity markets have also been on a tear, with plenty of extra room for 2022 – Source: Refinitiv Deals Data

From a sector perspective, technology and life sciences will remain dominant themes next year, he said. Regulatory concerns will also likely be increasingly relevant in M&A transactions.

Foreign direct investment (FDI) regimes are tightening in many jurisdictions along with a general drift towards greater regulatory scrutiny of corporate transactions. The ever-expanding universe of “sensitive” industries will present challenges for deal makers to navigate on cross-border deals.

“Supply chain recalibration is also an expected key theme. The pandemic shone a spotlight on the limitations of global supply chains and the risks associated with over-dependency on single or dominant source models. How this plays out will vary across regions and sectors, but the supply chain mix will be shaken up with knock-on implications for M&A activity,” said Eversheds Sutherland’s Cai.

He already sees M&A activity picking up again and, based on the visible pipeline and market signals, expects it to continue at least through the first half of 2022.

“But there are many potential uncertainties and it is risky to predict exactly how markets will behave coming out of a once-in-a-century pandemic,” Cai said.

How in-house counsel can adapt to M&A in 2022

In-house counsel teams are typically smaller than external law firm teams and the inability to work collaboratively with business colleagues in the regular office environment during the pandemic was a particularly isolating experience for some.

But the pandemic has also changed many aspects of the job in healthier ways.

In recent years, for instance, many in-house lawyers have taken on a more proactive and strategic role in the M&A process and this trend has further accelerated during the pandemic – whether through leading or taking a key part in valuation analyses, negotiations, due diligence, contracts and deal closing.

In-house counsels also play a particularly important role in early stage planning and issue-spotting – helping their business teams to prepare for anticipated M&A activities and identifying potential gating issues early. For instance, early due diligence processes may commence before external advisers are on board and in-house lawyers need to guide their deal teams on initial legal process and structuring considerations.

The rise of the Zoom conference call meant companies more often negotiating and signing deals virtually, with colleagues and counterparties dispersed around the world, rather than the traditional face-to-face, ‘lock everyone in a room’ approach to get deals over the line.

But, at least for some in-house counsel, over-reliance on Zoom can re-introduce the dreaded “meeting curse.” What could be solved in a few minutes with a simple phone call or corridor discussion can end up taking an hour if the parties insist on using Zoom. This has impeded quick decision making in some scenarios and it will be important to find a better balance in 2022.

More changes to the profession are expected over the next year as a flow-on effect from Covid-19. Alongside these changes will come more work. In-house lawyers in 2022 will need to balance their mental health with the increased workload.

While there have been positive steps taken by many law societies in trying to deal with well-documented mental health concerns in the legal profession, these can be a particular challenge for in-house lawyers who often do not have deep teams to share the workload. More can be done to help lawyers achieve a better work-life balance and keep them operating at a high level for longer.

By Nathan Smith

Charles Butcher, Partner, Head of International M&A, Asia Charles heads the international M&A and private equity team in Asia. He focuses on regional and international cross-border transactions and investments. He has represented clients on acquisitions, disposals, joint ventures, restructurings and financing transactions throughout the Asia-Pacific region. |

Roderick Lai, Partner Rod is a Partner in the corporate team in Hong Kong and principally acts on cross border M&A, private equity backed deals and joint ventures. |

Jack Cai, Managing Partner, Shanghai Jack is the Managing Partner of Eversheds Sutherland’s Shanghai office. He specializes in cross-border mergers and acquisitions, China-related investments, employment law, general commercial law, data privacy, corporate restructuring and general corporate and regulatory advisory. |

Eversheds Sutherland

37/F, One Taikoo Place, Taikoo Place, 979 King’s Road, Quarry Bay

Hong Kong SAR