By Norhisham Abd Bahrin, AZMI & Associates

By Norhisham Abd Bahrin, AZMI & Associates

The growth of small and medium-sized enterprises (SMEs) has played a significant role in the process of industrialisation worldwide. To support the growth of SMEs, an audit exemption regime has been implemented in various advanced countries, such as Singapore and the UK.

In Malaysia, Section 267(1) of the Companies Act 2016 mandates every private company to appoint an auditor for each financial year of the company for purposes of auditing its financial statements. Notwithstanding this, Section 267(2) of the Companies Act 2016 empowers the Registrar of Companies to exempt any private company from auditing its financial statements.

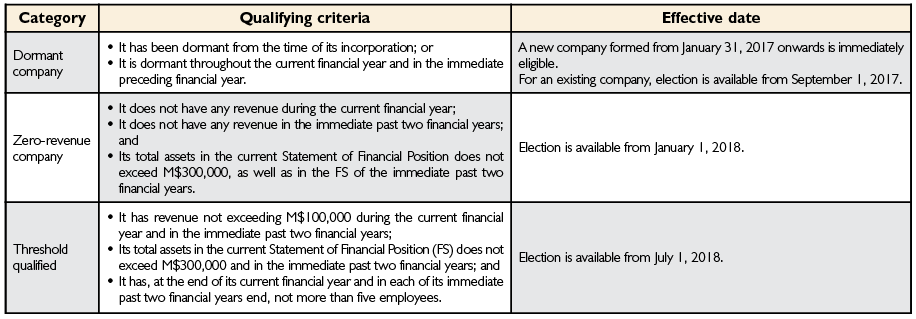

On August 4, 2017, the Companies Commission of Malaysia (CCM) has brought into force audit exemption for certain categories of private companies. The Companies Commission of Malaysia has issued Practice Directive No. 3/2017 to set out the qualifying criteria for private companies to be exempted from appointing an auditor for a financial year.

Categories of private companies that qualify for audit exemption

This audit exemption allows startups and SMEs to enjoy cost-savings in the running of their business since appointment of auditors is no longer necessary.

Issues to consider

Audit-exempt companies will still be required to prepare unaudited financial statements and lodge them with the CCM except that the audit-exempt companies can choose to not have those financial statements audited. However, the board is still required to rely on audit/accounting firms to prepare the unaudited financial statements in accordance with the approved accounting standards and the Malaysian Accounting Standards Board (MASB). The unaudited financial statement must be circulated to the board members in accordance with the Companies Act 2016. Hence, it may not make much of a difference from a full audit exercise if one is to look from a cost perspective.

Furthermore, the Inland Revenue Board (IRB) requires all companies to report their income based on audited accounts. However, it remains to be seen whether the IRB will handle tax returns submitted based on unaudited accounts differently.

As a result of audit exemption for certain private companies, it is uncertain as to how banks and other financial institutions will alter their current practice of requiring audited accounts to be submitted together with applications for financial facilities and for maintaining financial facilities and whether such institutions will still require that audited accounts to be submitted.

The Malaysian Institute of Accountants (MIA) is in favour of audit exemptions for dormant companies only but not for other small companies. According to MIA, the significance of an audit cannot be taken lightly. Audit helps the management to maintain an effective system of internal controls and deters fraud, money laundering and other illegal activities. Audit-exemption will result in the situation where the accuracy of financial information in unaudited financial statements filed with CCM become questionable. As a consequence, this will cause increase monitoring, compliance and enforcement cost to CCM. In fact, Hong Kong does not allow audit exemption for small private companies, except for dormant companies.

In conclusion, the introduction of audit-exemption brings Malaysia to be in line with other advanced countries such as Singapore, the UK and Australia. Considering the issues raised above, it remains to be seen whether the introduction of audit-exemption in Malaysia is a step forward.

T: 603 2118 5000 Ext 5016