By Peter Ch’ng, CONYERS

By Peter Ch’ng, CONYERS

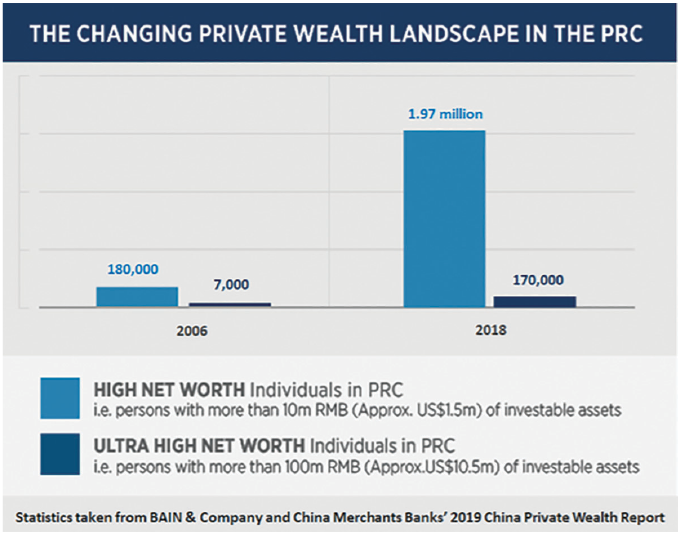

Driven by an exceptional period of Chinese entrepreneurship in the last decade, high-tech manufacturing, IT and fintech are now key components of the Chinese economy spawning the momentous growth of China’s nouveau billionaire class and poised to overtake the US.

However, more than 80% of family enterprises in the People’s Republic of China (PRC) are still controlled by the first generation of wealth creators and a massive transfer of assets to the second generation is just getting started. Affluent Chinese family leaders are no longer just focused on creating wealth; they are dealing with succession planning for their businesses and wealth inheritance. A top priority is to create an enduring legal structure that will preserve family ownership, frequently involving reserved-power trusts.

Private wealth generally falls into two categories. The first is hard assets in the form of the family business’s operating company and real estate, which are by far the most important assets in terms of succession planning. The second is liquid assets and investments. Structuring the ownership of each type of assets require different treatment, based on many factors such as location, access to capital, deal flow, tax efficiency, legal protection and personal safety.

Wealth planning is also triggered by a variety of life events, such as immigration, divorces, children’s education and marriages, and by business life-cycles, such as initial public offerings (IPOs). Since 2013, owing to the simplification of rules by the China Securities Regulatory Commission, small and mid-size companies have found it easier to publicly list their businesses on overseas capital markets such as the Hong Kong Stock Exchange. Offshore trust planning can be very important in preparing for an IPO, when family assets and shares of the major shareholders are re-organised and formalised in a trust structure such as a BVI VISTA trust, and employee incentive benefit plans with shares and options held in trusts are put in place.

While tax is not always a driver for asset shelter and re-organisation, the Individual Income Tax (IIT) Reform in the PRC effective from January 2019 had and continues to have a significant impact on tax and estate planning by high-net-worth individuals. Historically, a PRC person with a permanent residence in the PRC paid PRC income tax on income earned in the PRC. The IIT tax reform, among other things, redefined tax residence and domicile concepts to cover PRC individuals who maintain PRC household registration, vital economic interests and family ties in and to the PRC to be taxed on a worldwide basis, notwithstanding residing mostly outside of the PRC. Some who have the means are actively exploring avenues to become “non-domiciles” through emigration, dual citizenships passports and trust/nominee arrangements of foreign holdings to legitimately minimise that exposure. The PRC also enacted a general anti-avoidance rule (GAAR) and controlled foreign corporation rule to tighten tax loopholes. For example, GAAR empowers the tax authorities to assess tax on individuals who are involved in transactions, such as asset transfers, which are not at arm’s length. There is a risk that where a PRC settlor gifts or transfers assets to a trust or effects a capital contribution and/or structures an asset loan to the trust, that may trigger a taxable event that could cause the settlor and/or trustee to become liable to PRC tax. The trust assets (and trustees) may be at risk from the claims of the tax authorities. This more than ever highlights the importance of obtaining proper onshore tax and legal advice prior to offshore planning, as well as strengthening trustee indemnities.

The Automatic Exchange of Information (AEOI)/Common Reporting Standard (CRS) continue to be an area of concern for HK/PRC citizens using offshore vehicles, given that the PRC and our practising jurisdictions (Bermuda, the Cayman Islands and BVI) are signatories to these agreements. Legitimate solutions to mitigate CRS disclosures to preserve family privacy continue to be a topic of great interest.

There is also cautious interest in using Bermuda or Cayman foundations as an alternative to trusts, given the recent judicial onslaught on trust structures in the onshore courts (the infamous UK Pugachev case) and the failed but nevertheless costly attempt to erode “anti-Bartlett” provisions in the Hong Kong Court of Appeal case of Zhang Hong Li vs. DBS Hong Kong (2018). A Cayman foundation, a statutory hybrid between a trust and trustee managed by a board of directors like a corporation, is seen by some practitioners as being free of the foibles and legal baggage of trust law and a superior structure.

As Chinese wealth has become more internationalised and the world continues to develop increasingly complex rules to achieve global tax transparency, a different more nuanced, personalised and sophisticated approach to wealth management is called for. A multi-jurisdictional approach is often necessary, involving different structures for different assets in different jurisdictions to provide targeted solutions to meet diverse issues. There is no more one-size fits all.

![]()

T: (852) 2842 9593