Despite an animated exchange of opinions regarding consent decrees since their introduction in Korea in 2011, expect the system to be used more actively in the future as companies have begun to view it as a viable way to resolve free-trade cases, write Chang-Ho Kum, Kenneth T Kim and Jin Woo Hwang of Yoon & Yang.

Regardless of the name used to refer to it, the common principle of a consent decree is that the suspected enterpriser voluntarily proposes reasonable remedies, such as restoration of status quo and consumer injury relief, etc., and the competition authority closes the case without defining the illegality of the conduct if it finds the proposed remedies reasonable after undergoing the market test. In Korea, while the Korea Fair Trade Commission (KFTC) pursued the introduction of the consent decree system from 2005, it was introduced in 2011 under the Monopoly Regulation and Fair Trade Act (MRFTA) as a follow-up action to the Korea-US Free Trade Agreement, and also later applied to the Fair Labeling and Advertising Act in December 2013.

A consent decree has several advantages. The competition authority can economise the administrative costs required for determination and substantiation of illegality. Moreover, a consent decree can promptly and effectively restore market order. The investigated company may also save on costs and secure a degree of legal stability while simultaneously preventing damages to its reputation by swiftly resolving the case without admitting to any illegality of the investigated conducts. Prompt resolution of the case is particularly important for dynamic and innovative industries, such as the IT industry, where the market is often subject to rapid changes and innovations that could make any decision by the competition authority outdated due to the already changing market conditions.

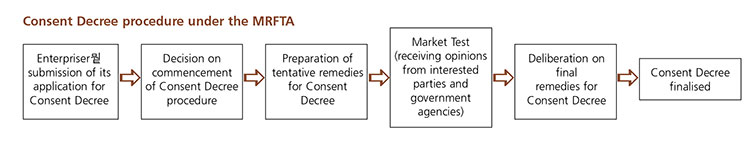

Under the laws of Korea, cartels and any conduct that requires criminal punishment based on clear and serious extent of the violation are excluded from subject matters eligible for a consent decree. In addition, the consent decree procedure also requires consultation with the attorney general before the consent decree is issued. The consent decree procedure in Korea proceeds in the order described in the diagram below:

|

After the introduction of the consent decree system in 2011, four of the five applications were resolved, while one application was rejected by the KFTC.

Internet portal enterprises’ abuse of dominance cases

In October 2013, the KFTC issued an Examiner’s Report to Naver and Daum, two major Korean internet portal enterprises, focusing on the following five conducts: (i) providing internet portal enterprises’ own paid specialised services together with the search results; (ii) posting general search results and search advertisements without distinguishing them; (iii) restricting the transfer of advertisers secured by specific advertising agencies; (iv) demanding priority negotiation rights when executing a network search advertisement partnership agreement; and, (v) dispatching personnel to affiliate companies.

In November 2013, Naver and Daum applied for a consent decree and the KFTC decided to commence the consent decree procedure for the first time, taking into account the following factors: (i) the online search service market is an innovative market that requires consideration to its dynamic market conditions; (ii) online search is closely related to users’ daily lives and requires swift restoration of competition order; (iii) voluntary correction by the enterpriser can raise the efficacy of the remedies and sufficient injury relief can be secured if appropriate remedies are prepared; and, (iv) foreign competition authorities also applied consent decree procedures in similar matters.

After the commencement of the consent decree procedure, the KFTC held multiple discussions with the applicants and underwent the procedure for the market test regarding the tentative remedies. Subsequently, in March 2014, the KFTC approved the consent decree, which included the following remedies: (i) remove any possibility of user confusion and abolish or delete any questionable policy or contract, and separately from such proposed remedies, the consent decree sought to (ii) simultaneously secure and implement funds and businesses in the amount of W104 billion so that real benefits can be distributed to the consumers and small/medium enterprises. This case is noteworthy as the first application of the consent decree system in Korea.

Global software company’s unfair business practices case

In 2013, the KFTC was conducting an investigation on the termination clause under the software purchase agreement of SAP Korea, a manufacturer and seller of corporate software, including the following conducts: (i) refusal to accept buyer’s demand for termination of parts of the software purchase agreement, ie, licensing or maintenance agreements, on the ground of change of circumstances; and, (ii) SAP Korea’s right to terminate the agreement with software resellers at any time so long as SAP Korea provides a three-month prior notice.

In November 2013, SAP Korea applied for a consent decree while the KFTC investigation was still in progress. In April 2014, the KFTC decided to commence the consent decree procedure by considering the following factors: (i) the IT market, such as the software market, is a dynamic market characterised by rapid changes and also an innovative market where technical advancement is constantly occurring; (ii) foreign competition authorities also applied consent decree procedures, such as inducing voluntary remedies, to newly growing fields such as the IT industry; and (iii) prompt restoration of the competition order and injury relief are necessary.

Subsequently, through discussions with the KFTC and the market test, SAP Korea agreed to the following remedies: (i) amending or removing the challenged provisions in the relevant contracts, and separately from such contractual relief, (ii) taking measures to enhance user welfare and to secure coexistence among relevant participants in the market such as incorporating a public-interest corporation for establishing a foundation to utilise Big Data and educational training together with funds to assist the operation of such public-interest corporation, The above consent decree was approved by the KFTC in October 2014. This case is notable from the perspective that the KFTC’s consent decree caused a multinational company, ie, SAP, to change not only its policy in Korea, but also its global policy that had been maintained since its incorporation.

|

Microsoft-Nokia business combination case

From November 2013, the KFTC reviewed Microsoft’s merger filing regarding its acquisition of Nokia’s mobile handset business. The M&A division of the KFTC issued an examiner’s report (ER) in May 2016, which alleged the following: (i) Microsoft, which will own mobile patents and the ability to develop OS post-acquisition, would have an incentive and ability to distort competition by discriminately raising royalties against its competing handset manufacturers; and, (ii) the business partnership agreements (BPA) that Microsoft executed with a Korean handset manufacturer, before the acquisition, would raise the risk of sharing sensitive business information between competitors.

After submitting its response effectively rebutting the anticompetitive concerns alleged by the ER in July 2014, Microsoft applied for a consent decree in August 2014. The KFTC held the first hearing en banc on September 1, 2014, and through a number of subsequent negotiations with Microsoft regarding the remedies, the KFTC finally decided to commence a consent decree procedure for Microsoft at another en banc hearing held in February 2015. Subsequently, including 40 days of market test, the final consent decree was finalised in August 2015.

To address the concerns raised by the ER, Microsoft agreed on remedies including the followings: (i) Microsoft will comply with its FRAND commitment regarding SEPs; (ii) Microsoft will not raise its royalties for non-SEPs for a certain period; and (iii) Microsoft will remove the information exchange clauses from the BPA. The Microsoft-Nokia case is noteworthy in that it is the first merger case resolved through the consent decree procedure.

Film enterprises’ abuse of dominance cases

Not all applications for consent decree have been accepted by the KFTC. In December 2014, the KFTC rejected the application for a consent decree filed by film enterprises CJ and Lotte for its abuse of market dominance case. The conduct at issue involved advantageous and discriminatory treatments in regard to films distributed by their affiliates or by themselves directly, which included provision of a greater number of screens and longer screening periods.

After the receipt of the ER in October 2014, CJ and Lotte applied for a consent decree in November 2014. However, the KFTC refused to accept such application by deciding that the subject matter was inappropriate for a consent decree considering the following factors: (i) the characteristic of the case, such as the patency of evidence for the relevant conduct; (ii) the timing; and, (iii) the consistency with the public interest, such as consumer protection. Subsequently, the KFTC resumed its normal deliberation procedure, and imposed corrective orders, surcharges and filed a criminal complaint with the prosecutor’s office against both enterprises.

To date, the CJ and Lotte cases are the first and only example where the KFTC rejected an application for a consent decree. However, their importance lies in the fact that they present the standard for determining the circumstances under which the KFTC prefers to handle a case based on normal procedure over the consent decree procedure.

Wireless carriers’ violations of Labeling and Advertising Act cases From October 2014, the KFTC initiated an investigation into whether three Korean wireless carriers (ie, SK Telecom, KT and LG U Plus) committed a violation of the Fair Labeling and Advertising Act by advertising certain LTE services as providing “unlimited” data, voice or text messaging. All three carriers applied for a consent decree in October 2015. The KFTC decided to commence the consent decree procedure in December 2015 by considering the following factors: (i) prompt remedies are required for the market since it is an innovative market which changes rapidly pushed by technical development; (ii) any deception to wireless service subscribers requires immediate correction; (iii) voluntary correction by carriers can enhance the efficacy of the KFTC’s law enforcement, and direct and sufficient compensation to consumers is possible; and (iv) foreign competition authorities actively applied the consent decree procedures to similar matters involving deceptive advertising.After undergoing the market test on the tentative remedies that were agreed upon by the three carriers and the KFTC in March 2016, the consent decree was finally approved by the KFTC in September 2016, which included the following remedies: (i) changing the names of the service and rectifying the challenged issues in the relevant advertisements and webpages; and, (ii) providing certain compensations to the subscribers of the challenged LTE data services. These were the first Fair Labeling and Advertisement Act cases resolved through the consent decree procedure. |

|

* * * * * * * * *

In light of the frequency of usage of the consent decree system in the US and the EU, it is difficult to describe Korea as one of the jurisdictions with vibrant usage of the consent decree system as a means of competition law enforcement due to its short history. However, based solely on the five consent decree applications discussed above, the obvious trend is the KFTC’s use of the consent decree in innovative markets, such as IT and wireless industries. Moreover, in deciding whether to commence the consent decree procedure, the KFTC considers not only the need for prompt restoration of competition order and the necessity of consumer injury relief, but also the use of the consent decree by other foreign competition authorities in similar matters.

Since the 2011 introduction of the consent decree system in Korea, examples of utilisation of the consent decree system have been accumulating. Korea has experienced animated exchange of opinions regarding the operation of the consent decree system. Also, companies have begun to view the consent decree as a viable resolution for KFTC cases. In light of the numerous advantages of the consent decree system and the frequency and examples of utilisation in other countries, the consent decree system in Korea is expected to be used more actively in the future.

––––––––––––

E: chkum@yoonyang.com

ktkim@yoonyang.com

jwhwang@hwawoo.com

W: www.yoonyang.com