E: tglasgow@imf.sg

W: www.imf.sg

UPDATE: 15th June 2017: The Hong Kong Legislative Council has passed the law allowing 3rd party funding for arbitration in Hong Kong.

Asian-mena Counsel speaks to Tom Glasgow, investment manager for Asia at IMF Bentham, about the environment for third-party funding in the region.

ASIAN-MENA COUNSEL: What is the current scope of third-party funding in Asia?

Tom Glasgow: Demand for commercial financing of litigation, arbitration and insolvency cases is growing steadily across jurisdictions in Asia.

In the leading centres for international dispute resolution, Singapore and Hong Kong, legislative changes are paving the way for third-party funding of international arbitration and associated court proceedings. These changes complement a steady upward trend in the courts’ willingness to approve funding arrangements in those jurisdictions, including in respect of insolvency claims and in cases where it facilitates access to justice.

In some jurisdictions, the restrictive doctrines of maintenance and champerty are still prevalent; or alternatively, there is a grey area where third-party funding is neither expressly permitted nor expressly prohibited. As demand for litigation finance increases, we expect to see appropriate reforms to expand the circumstances in which funding is permitted through a healthy dialogue between regulators, funders and users of the system.

The position is fast evolving and we encourage in-house lawyers to assess their financing options when considering any potential commercial claim within the region.

AMC: Can you briefly explain the concepts of champerty and maintenance?

TG: These common law doctrines were introduced in 12th-century England to prevent wealthy barons abusing the justice system to achieve personal aims. Maintenance is the support of litigation by an individual without a legitimate interest in the case. Champerty is an aggravated form of maintenance in which the uninterested party seeks to profit from the outcome of the case.

Tom Glasgow

AMC: When is third-party funding appropriate?

TG: There are many situations where third-party funding might be suitable. The most obvious is where a claimant does not have the funds to pursue a case. We also receive inquiries from in-house lawyers seeking to use third-party funding as a tool to manage the risks and costs of commercial claims. Funders like IMF effectively allow claimants to transfer all costs (including the risk of adverse costs awards) to a third party, while retaining the bulk of any recovery.

In a world of tightening legal budgets and increasing legal costs, this is often an attractive proposition that permits the allocation of legal spend towards other important front-end work. There may also be a significant benefit from an accounting perspective: if costs can be outsourced to the funder’s balance sheet, companies no longer face the monthly drag on P&L.

Clients seeking funding for a case typically approach us at the outset of the dispute, sometimes even before legal advisers are appointed. We are also approached later in the life-cycle of a matter, at the appeal stage or when complex enforcement is required, as parties begin to suffer from the “fee-fatigue” of a drawn-out case.

Claim value is also important. There must be a sound claim in damages of sufficient value to provide a return to the claimant and to the third-party funder. At IMF, our objective is that the majority of any amount recovered is retained by the claimant, and for this reason, we prefer to fund cases where there is a minimum ratio of 10:1 between the claim size and the estimated costs of pursuing the case. Claims for declaratory or injunctive relief only are unlikely to obtain funding.

As explained earlier, there are also regulatory considerations. Some countries are yet to embrace third-party funding and care must be taken, especially if a case is likely to involve multiple jurisdictions.

One evolving area of our business is financing for a portfolio of commercial disputes, an innovative solution which allows a company to reduce its disputes costs or eliminate them entirely from its balance sheet. In jurisdictions that allow law firms to operate on a contingency-fee basis, such as the US, a funder might also finance a law firm’s portfolio of cases.

AMC: How does IMF Bentham decide which cases to take on?

TG: IMF has been operating for over 16 years and is one of the global pioneers of the third-party funding industry, which began in Australia in the late 1990s. We have a team of over 25 investment managers (all ex disputes lawyers), spread across 11 offices around the globe, who carry out extensive due diligence on any matter that passes our initial investment criteria. Broadly, we are looking for meritorious claims of US$7 million or above (less for insolvency) enforceable against a solvent defendant.

We run our due diligence process in close partnership with the client and lawyers. We start by assessing the defendant, its asset position and any likely difficulties on enforcement of a judgment or award. We then assess important risk factors such as the claim value, the budgeted legal costs, the case theory and likely defences, the nature of the claimant, its witnesses and its legal representatives, issues of expert evidence and the relevant regulatory environment for funding.

This extensive due diligence exercise is not only for IMF’s benefit. By front-loading the development of a case and identifying potential risks we often find we are able to help shape a stronger case theory which can be run more efficiently; alternatively, if significant issues are identified, the wasted costs of pursuing a weak claim are often avoided.

AMC: What is the best way to approach a funder and package a claim?

TG: The more prepared your application for funding is, the quicker it can be processed. IMF will need to understand, as a minimum, the nature of the defendant and any enforcement risks, any advice from legal counsel, the core underlying evidence and the basis for calculation of the claim value, as well as the likely cost of pursuing the case. The best way to start is usually to prepare a short memo which gives the funder an overview on these key points.

Our assessment is necessarily an objective one and it is important to bear this in mind. We like to take an open and forthright approach. Every case has risks, so the aim is to identify the key risks and work collaboratively to address them. An example is helping to devise an effective enforcement strategy, to minimise the risk that a judgment or award goes unrecovered.

It is not necessary to have the complete package before you contact IMF. Our investment managers will work with you to ensure we have everything we need — and we can provide preliminary funding to help meet the costs of early stage investigations, such as counsel’s opinion or an asset report on the defendant. Nor is it necessary to instruct external lawyers before you seek funding. We have an extensive network of trusted lawyers and experts and can recommend the best individuals for a given case.

AMC: How much of their recovery will claimants typically have to share with a third-party funder and how is this decided?

TG: Our investment portfolio gives you a statistical answer to this question. We have concluded over 150 cases since listing in 2001, generating nearly A$1.3 billion in recoveries for clients from A$2 billion in revenue.

Each case is unique and the actual terms are a matter for negotiation between IMF and the claimant which will be recorded in the funding agreement. Typically, IMF would seek a return on its investment that is consistent with the level of risk in a case, calculated as the higher of either a multiple of our project costs (ie, the amount spent on legal and other fees) or a percentage of the total amount recovered by the claimant. Often our return will operate on a sliding scale such that an early settlement results in a lower fee.

AMC: What are your views on requirements to disclose funding arrangements during a dispute?

TG: IMF has always favoured a transparent approach. For example, in Australian funded litigation we typically lodge a deed poll with the court, confirming our position as funder and that IMF will pay any adverse costs orders incurred during the term of the funding agreement. This avoids any likely application for security for costs and allows the parties to get on with what matters — the substance of the dispute.

In arbitration cases, widely accepted international guidelines require that arbitrators disclose relationships which might denote a potential conflict of interest, including a relationship with a third party who has an interest in the outcome of a case. Disclosure helps to avoid the risk that a conflict of interest undermines the arbitral award. If the funder also undertakes to meet adverse costs, this should weigh against any application for security for costs.

Finally, our experience suggests that knowledge of the existence of a funder often serves to “level the playing field”, prompting a fairer process and increasing chances of settlement. That said, disclosure should only extend to the identity of the funder and confirmation of whether it is paying adverse costs. The remaining terms of a funding agreement are confidential and irrelevant to the substance of the dispute.

AMC: Finally, what is your outlook for third-party funding in Asia?

TG: We expect Asia to remain a high growth region for the industry as the market for litigation finance becomes more sophisticated and more jurisdictions reform their laws to cater for the changing demands of modern legal services. IMF has committed to the region, opening its first Asia office in Singapore this year, which will service our increasing local case-load and expansion. We are excited about the future of our business in Asia and looking forward to working with all our business and law firm partners across the region.

Tom Glasgow leads IMF Bentham’s Asia office, responsible for assessing and managing funded cases throughout Asia, including arbitration, litigation, insolvency and portfolio finance. Prior to joining IMF Bentham, Glasgow was a senior member of a leading international arbitration and disputes practice in Asia.

For more Dispute Resolution Special Report in this issue

Asia gears up for international arbitration

Asia gears up for international arbitration

Developments across the region are supporting the development of alternate dispute resolution mechanisms that will promote further investment into Asia’s …

Q&A – Katherine Yap, chief executive of Maxwell Chambers

Q&A – Katherine Yap, chief executive of Maxwell Chambers

Singapore’s Maxwell Chambers is an integrated dispute resolution complex housing best-in-class hearing facilities and support services, as well as top international alternate dispute resolution (ADR) institutions. …

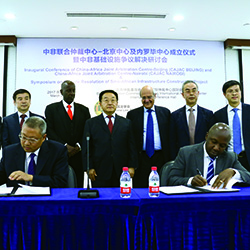

The role of arbitration in promoting Sino-African trade and investment

The role of arbitration in promoting Sino-African trade and investmentIn March, the Beijing Arbitration Commission/Beijing International Arbitration Centre (BAC) and the Nairobi Centre for International Arbitration (NCIA) formally founded the China-Africa Joint Arbitration Centre…