By Quyen Hoang, Trang Nguyen, Tam Ngo, LNT & Partners

The Vietnamese insurance market is heating up with many high-valued merger & acquisition (M&A) deals over the last two years. Some exemplary examples are Hyundai Marine & Fire Insurance’s acquisition of a 25% stake in VietinBank Insurance in December 20181; Sumitomo Life Insurance Company’s increase of its ownership in Bao Viet Holdings from 17.48% to 22.09% in December 20192, and FWD Group’s acquisition of Vietcombank-Cadiff Life Insurance in April 20203. Furthermore, according to publicly available information, many other deals are in the process of negotiation, promising a vibrant insurance M&A market in the near future.

Quyen Hoang,

The insurance industry is highly regulated, especially when it comes to M&A activities. Undeniably M&A, including share/capital acquisition, is one of the fastest ways to expand business in the insurance market due to the existence of domestic distribution channels and a stable clientele. Moreover, insurance is a special industry that could cause tremendous disruptions to thousands of lives and create ripple effects throughout the whole economy if there is any non-compliance issue in its operation or, in the worst case, an insolvency. For these reasons, share/capital acquisition in insurance companies has been strictly supervised by the Vietnamese government.

This article will outline the current legal framework governing share/capital acquisition in insurance companies. Applicable requirements are stipulated in (i) insurance business laws; and (ii) competition laws.

Trang Nguyen

Requirements in Insurance Business Laws

Article 22 of Decree 73/2016/ND-CP dated 01 July 2016 guiding the detailed implementation of the Law on Insurance Business (“Decree 73/2016/ND-CP”) provides that an acquirer of shares/capital in a Vietnamese insurance company (target company) must satisfy:

General conditions which are applicable to all acquirers:

(i) Source of finance

The acquirer must contribute capital in cash and must not finance the acquisition by loans or entrusted investment capital from other organizations or individuals.

(ii) Capital requirement

The acquirer must ensure that the difference between its equity and its legal capital is at least equal to (i) the amount of capital intended for contribution to the target or (ii) the sum to be paid to the seller.

Tam Ngo

(iii) Profitability

If the acquisition is of ten (10) per cent or more of the charter capital of an insurance company, the acquirer must be profitable for the three (03) consecutive years immediately preceding the year of the proposed acquisition.

(iv) Others

Where the acquirer is an insurance enterprise, an insurance broker, a commercial bank, a financial company or a securities company, such acquirer must ensure the maintenance and satisfaction of financial prudence conditions, and be permitted by the competent agency to conduct share/capital acquisition in accordance with the applicable specialized laws.

Specific conditions:

(v) Type of acquirer

The acquirer must be (a) an organization to acquire capital contribution in a limited liability insurance company; or (b) either an organization or individual to acquire shares in a joint stock insurance company.

(vi) Total assets

Except for foreign acquirers, which are further subject to the conditions set forth below, the acquirer must have minimum total assets of VND 2,000 billion in the year immediately preceding the year of the proposed acquisition.

Foreign acquirers are also required to satisfy the following conditions:

(i) Type of acquirer

The acquirer must be (a) a foreign insurance enterprise permitted by the competent foreign agency to conduct business in the relevant sector, or (b) a subsidiary of a foreign insurance enterprise specializing in conducting offshore investment which is authorized by such foreign insurance enterprise.

(ii) Experience

If the acquisition is of shares/capitals of a limited liability insurance company, the acquirer must have at least seven (07) years’ experience in operating in the sector in which it proposes to carry out business in Vietnam.

(iii) Total assets

The acquirer must have minimum total assets of USD 2 billion in the year immediately preceding the year of the proposed acquisition instead of VND 2,000 billion as applicable to Vietnamese acquirers;

(iv) Compliance records

The acquirer must not have committed any serious breach of the law on insurance business activities of the country where it is headquartered in the three (03) years preceding the year of the proposed acquisition.

It is worth noting that acquisitions of ten (10) per cent or more of the charter capital of an insurance company must obtain prior written approval from the Ministry of Finance (MOF). After completion, the target company must inform MOF of the completion for record and to amend the license (if applicable).

As can be seen, many conditions will be applicable to acquirers depending on whether they are Vietnamese or foreign ones. However, the method of determining “a foreign acquirer” under Vietnamese laws is based not only on the country of incorporation.

According to Article 23 of the Law on Investment 2014, an entity must satisfy the conditions and carry out investment procedures in accordance with regulations applicable to foreign entities if 51% or more of its charter capital is held by (a) a foreign entity; or (b) an entity 51% or more charter capital of which is held by a foreign entity; or (c) a foreign entity and an entity prescribed in item (b) (Under the Law on Investment 2020 which will take effect from 1 January 2021, such 51% threshold will be reduced to “more than 50%”) . Therefore, if the acquirer fits the above definition, it may need to satisfy the conditions applicable to foreign entities which are far stricter than those applicable to Vietnamese entities. It is understood that the Vietnamese government follows this approach to determine who is a “foreign acquirer” in the insurance M&A context. Consequently, it follows that a Vietnam incorporated acquirer which is fifty-one (51) per cent or more owned by a foreign entity might be deemed a foreign acquirer when conducting share/capital acquisition in insurance companies in Vietnam.

Requirements in Competition Laws

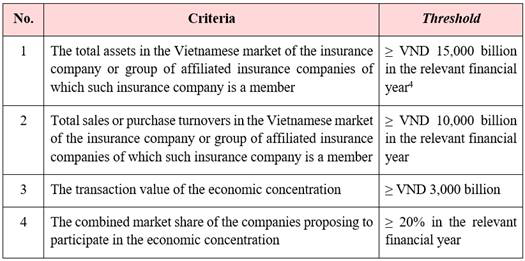

According to Article 13.2 of Decree 35/2020/ND-CP dated 24 March 2020 on detailed implementation of the Law on Competition (“Decree 35/2020/ND-CP”), an insurance company contemplating to participate in an economic concentration, including share/capital acquisition, must notify the National Competition Committee (“NCC”) before implementing such economic concentration if any of the following thresholds is satisfied:

Moreover, it is worth noting that pursuant to Article 13.3 of Decree 35/2020/ND-CP notification thresholds No. 1, 2 and 4 above shall also apply to offshore economic concentrations. Effectively, even if the share/capital acquisition of insurance companies, who have affiliates/subsidiaries in Vietnam, occurs entirely outside of Vietnam, such transactions are also subject to merger filing requirements under Vietnamese laws. Specifically, these transactions will be assessed against thresholds No. 1, 2, and 4 above and must be notified if any of these thresholds is met.

Endnotes:

- https://vneconomictimes.com/article/banking-finance/hyundai-marine-fire-insurance-buys-25-of-vietinbank-insurance#:~:text=(VBI)%20signed%20a%20stock%20purchase,up%20its%20expansion%20in%20Vietnam.

- https://vneconomictimes.com/article/banking-finance/sumitomo-life-raises-stake-in-baoviet-holdings

- https://www.fwd.com.vn/vi/thong-cao-bao-chi/2020/fwd-mua-lai-vcli/

- Such means the financial year immediately preceding the year of the contemplated economic concentration.